Despite how it may seem in movies, criminal proceeds are not so easy to spend without putting the criminal at risk of being caught. When criminals have large sums of money that need to be laundered, it’s no small feat and requires a lot of ‘leg work’ from others.

Criminals employ accomplices and intermediaries to help move the funds, allowing them to launder money more effectively and conceal the proceeds of their crimes. Ultimately, the faster this can be done, the faster they can get to their cash.

Fortunately, money mules are often not savvy criminals themselves, making them much easier to catch. Read on to learn more about what a money mule is, how they work, and the red flags to look out for to prevent this kind of fraud.

What is a Money Mule?

A money mule is someone who moves money (to obscure the source of funds) obtained illegally on behalf of another individual. Funds can be transferred in person, digitally, or through mail/courier. Money mules can be - but are not always - aware they are involved in laundering money obtained illegally.

In reward for disguising the true source of the money, money mules are often paid a portion of what they are muling. Even when being compensated, some victims may not actually be aware that they are involved in money laundering, with the purpose of their money muling disguised as legitimate activity by the fraudsters. In other cases, the money mules are fully complicit in the money laundering activity - and sometimes other criminal activity that generated the funds.

How Does Money Muling Work?

Whether they know it or not, money mules are a key component of the money laundering process.

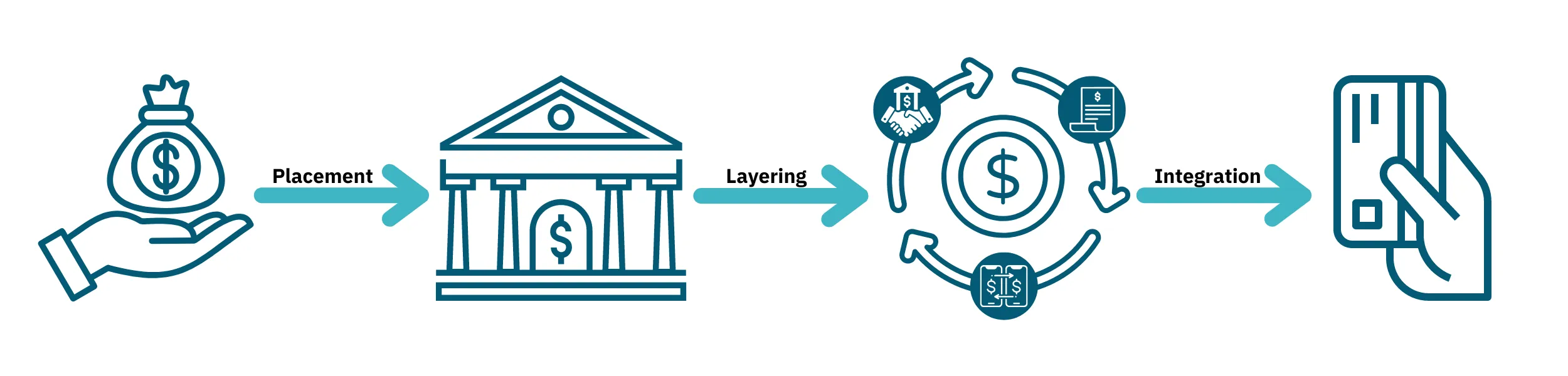

At the very least, money mules are participating in one of the 3 stages of money laundering: layering. They intentionally move funds to disguise where the money truly originated.

In some cases, mules may also be responsible for placement, where illegitimate funds are introduced to the legitimate financial system, and integration, where layered funds (which now appear legitimate) are returned to the criminal.

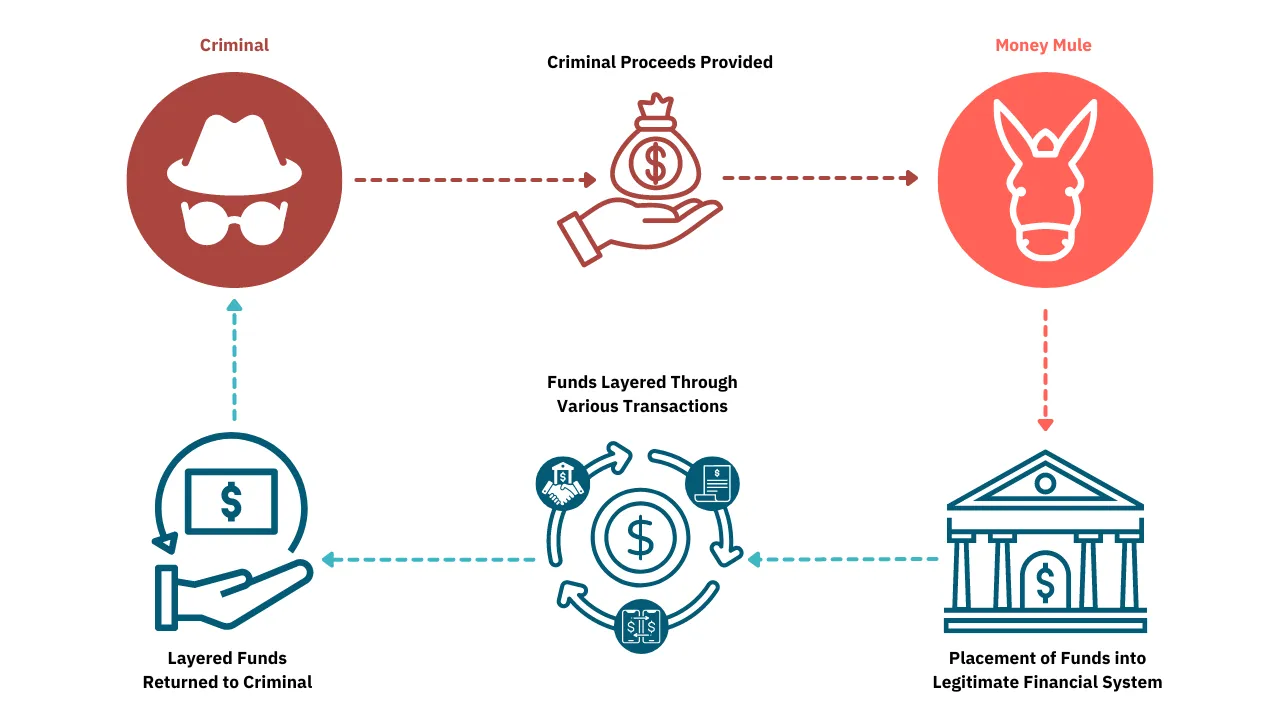

While money muling can be carried out in a multitude of ways, the core elements are the same. Below, we illustrate the money mule process:

- A criminal looking to launder money employs a money mule to layer illicit funds for them.

- The criminal transfers the funds to the money mule - either in person or electronically.

- The money mule either deposits money into the financial system or receives money that has already been integrated into the financial system.

- The money mule uses a series of transfers and transactions to layer the money.

- The money mule returns the layered funds back to the criminal.

In most cases, money mules are complicit in all 3 money laundering stages, whether they are aware or not. Let’s look at different types of money mules to understand how some may be entirely complicit, while others may be unaware they are committing crimes.

Common Types of Money Mules

For all intents and purposes, money mules are the same; or at least to financial institutions. You want to catch all of them, regardless of their intention.

However, money mules can be drastically different, mainly due to their awareness of their involvement in criminal activity. We explore this a bit more below.

- Unwitting money mule: Individuals that are unaware they are involved in criminal activity and engage in it thinking it’s legal. They are often tricked into performing this activity for someone they believe to be an employer, acquaintance, or even a romantic partner.

- Witting money mule: Individuals that should be aware they are involved in suspicious activity but engage in it anyway. While they aren’t fully aware they are engaged in criminal activity, they will have ignored clear indicators that what they are doing is illegal or suspicious in nature.

- Complicit money mule: Individuals that are aware they are involved in criminal activity and engage in it willfully anyway. This can range from inexperienced individuals who are unaware of what they are doing, to experienced, adept fraudsters that run entire money muling rings.

The distinction primarily comes down to whether the participants understand what they are doing is illegal, whether or not they intended to commit a criminal act, and their willingness to engage in the criminal act. Because of this immense spectrum, money mules can be charged to varying degrees.

Regardless of whether money mules are complicit in their crimes or not, it’s important for financial institutions to monitor for them. For financial institutions looking to root out this behavior, it’s essential to understand that these different money mules will have very different personas and behavior, aside from the money muling itself. It will be important to finely tune alert detection rules to catch all types of money mules

Ultimately, the best way to catch both witting and unwitting money mules is to monitor and analyze user behavior closely.

Now that we know the different kinds of mules, let’s look at who they target.

Businesses that are Susceptible to Money Muling

Businesses that are required to comply with anti-money laundering regulations must take measures to prevent money mule operations. That being said, by their nature, any businesses that deal in the exchange of funds are at risk of being exploited by money mules.

Organizations considered a common target are:

- Banks and neobanks

- Fintech services

- Cryptocurrency platforms

- Payment service providers

- Lenders and credit unions

- Investment firms and brokerages

- Currency exchanges (both fiat and crypto)

- Online gaming and gambling institutions

- Real estate and insurance companies

- Fundraising organizations

- Other financial institutions

Really, any business that facilitates that transfer of funds (or value of any kind) can be a target of money muling, as it provides fraudsters an avenue to launder money.

Fortunately, there are many ways financial institutions can identify suspicious activity conducted by money mules; we dive into them in the next section.

Money Mule Red Flags to Watch For

Money muling is a serious problem for organizations, as their company can quickly become an environment for money laundering.

Since money muling involves the transfer of funds, there are ways for financial institutions to detect money muling. By leveraging transaction monitoring tools, organizations can identify money muling - and then stamp it out.

Below, we cover some of the biggest red flags to look for to detect money mules:

- Access from different locations: Accessing the system from various remote locations or using a VPN to conduct transactions to a completely different location.

- Irregular deposits and withdrawals: Irregular deposits and withdrawals of money within a short period could be alarming.

- Risky jurisdictions: Making transactions and transfers to risky jurisdictions is a common red flag, as these areas are often targeted by mules for their inadequate AML controls.

- KYC/CDD: Some customers can be hesitant to provide the institution with their updated KYC information for verification purposes. This is often considered a red flag and should immediately prompt investigation.

- High-value transactions: Transferring large amounts of cash on a regular basis is a red flag that must be monitored on an ongoing basis.

It's vital to be vigilant and keep an eye out for the red flags—including non-monetary indicators—of a money mule scam. However, to properly protect against money mules, it’s important to know what scams to watch out for.

Money Mule Scams to Look Out For

It may sound outlandish, but many money mules are actually tricked into layering illicit funds. Whether it’s under the guise of a legitimate business relationship, a personal relationship (whether platonic or romantic), or some other means, mules are often employed without realizing what they are doing is a crime.

Below, we explore some of the most common money mule scams used to employ money mules. For financial institutions, this can help determine what personas to examine - despite them appearing legitimate at first glance.

1. Work-from-home job scams

Victims are tricked into working what they believe to be a legitimate job. Typically, the role is related to payment processing and requires the employee to accept and send transfers. While the money mule believes themselves to be working a legitimate job, they are actually just transferring criminal proceeds in a money laundering scheme.

Typically, these are remote jobs where the money mule can work from home. This appears to be a perk of the job, but in reality, it is an additional way for the criminal to remain anonymous. Job titles could include ‘payment processor,’ ‘financial manager,’ or even more broad roles like ‘administrative assistant.’

2. Romance Scam

An even more devious twist on the traditional romance scam; in this version, fraudsters leverage a romance fraud scam to lure the victim into money muling.

First, the criminal develops a relationship with the victim. They then convince the victim to transfer money for them, making up a fabricated story to justify this. They could claim to be an investor or simply convince the victim they need personal transfers done for them because they don’t have a working bank account.

In some cases, fraudsters will trick the victim into muling funds for them; in others, they’ll request access to the victim's personal bank accounts, later exploiting that access to launder funds.

3. Prize-winning scams

Criminals create a fake lottery or sweepstakes, telling an unsuspecting victim that they’ve won the grand prize.

Fraudsters then exploit the victim in one of two ways. They tell the victim they need to collect personal information in order to send money, and later use that information to take over their accounts.

Alternatively, they tell the victim that they require the fees and taxes to be paid prior to the prize being paid out (after the victim pays, the fraudster disappears and no prize is ever awarded).

Root Out Money Muling

Cutting-edge transaction monitoring and onboarding orchestration can help uncover money muling activities. With the ability to customize monitoring rules, these anti-fraud tools can be perfected to identify red flags and catch suspicious activity that may be fraudulent.

Learn more about Unit21

Unit21 is the leader in AI-powered fraud and AML, trusted by 200 customers across 90 countries, including Green Dot, Chime, and Sallie Mae. One unified platform brings detection, investigation, and decisioning together with intelligent automation, centralizing signals, eliminating busy work, and enabling faster responses to real risk.