.avif)

The AI company that fights financial crime for you

Real-time fraud prevention. Automated compliance. AI agents that investigate, learn, and improve across every stage of the lifecycle. This is AI Risk Infrastructure for fraud and AML, built for growth. Trusted by leading fintechs and financial institutions across the globe.

Focus on growing your business.

Let us handle the risk.

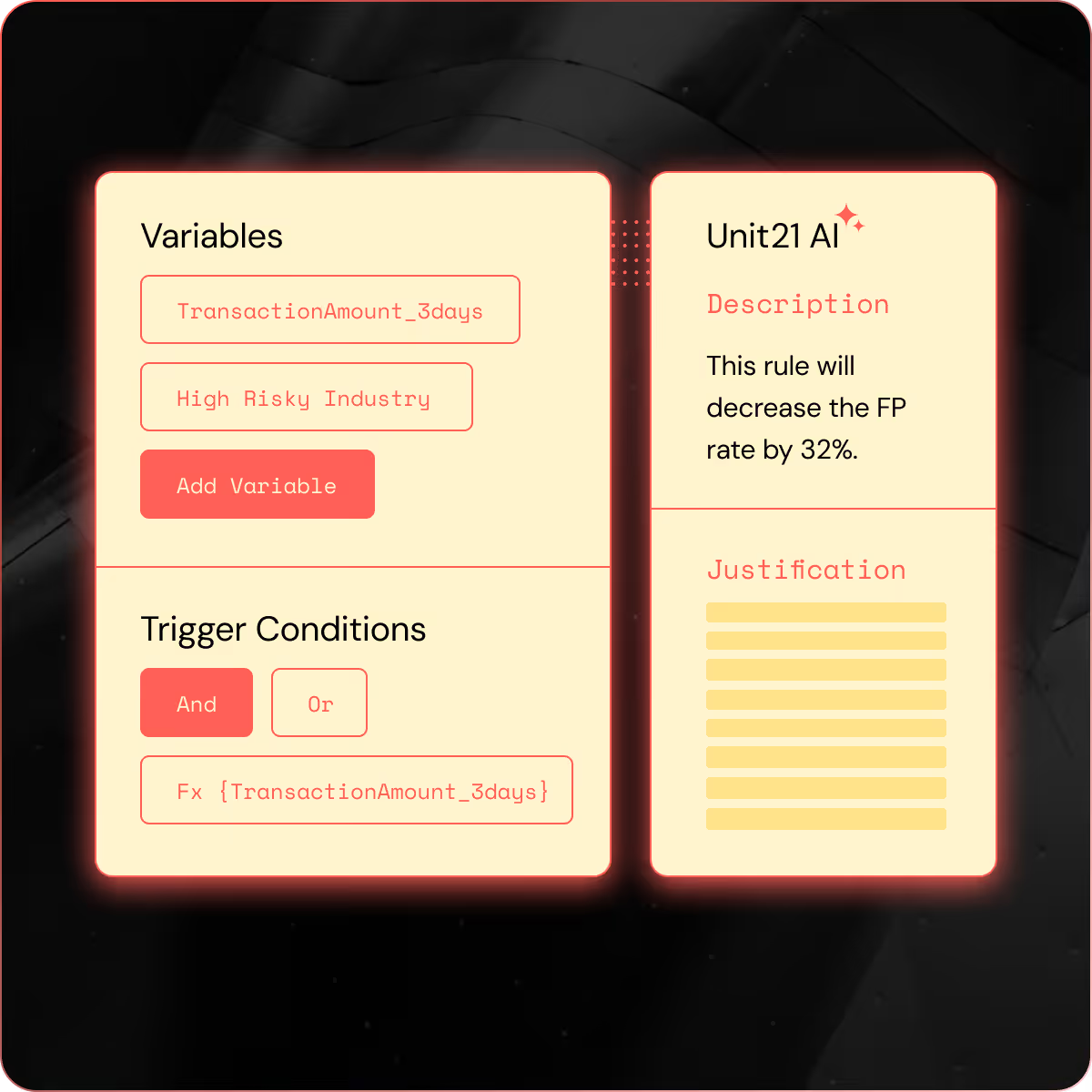

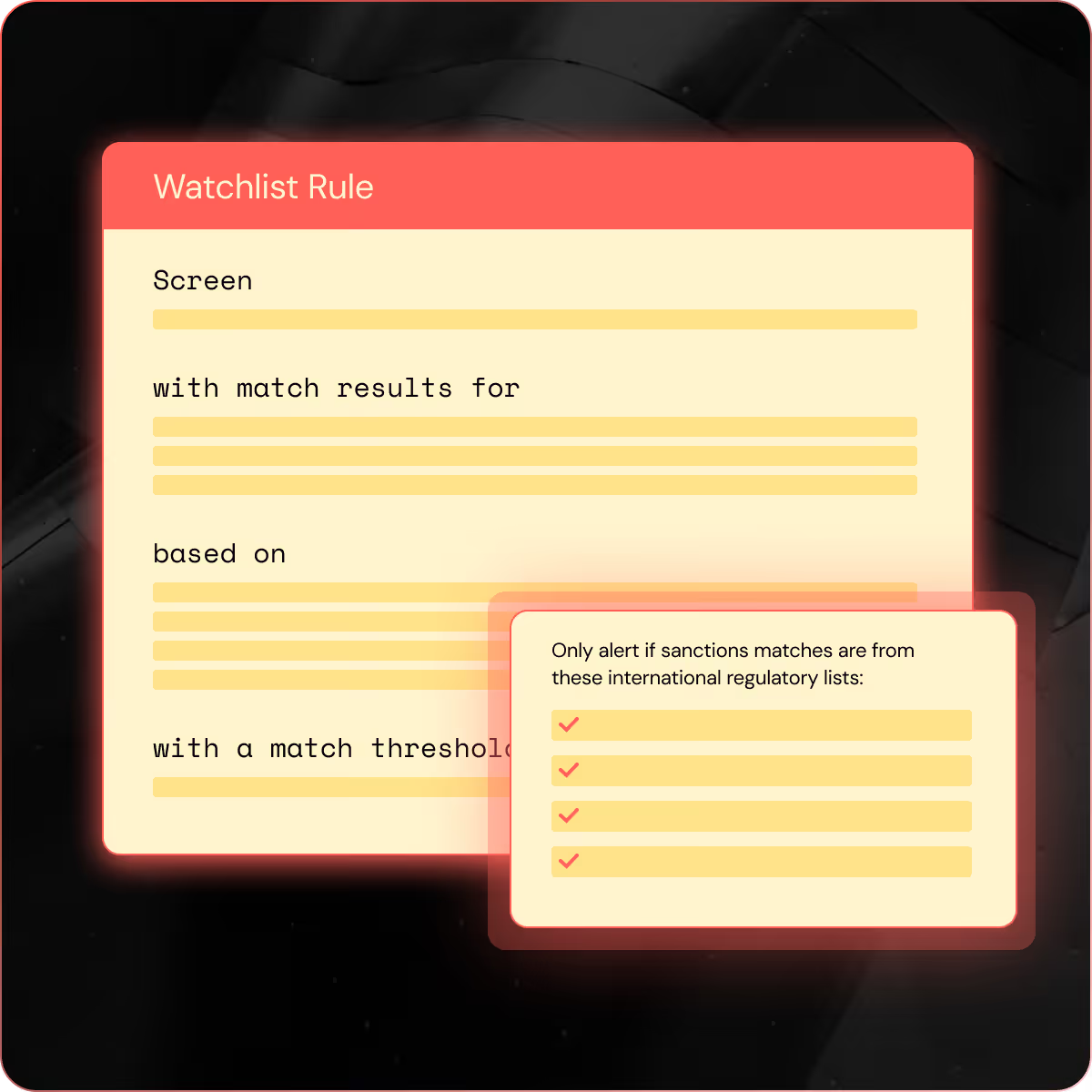

Built on a unified fraud and AML platform, Unit21 uses configurable AI agents to run the full financial crime lifecycle: detecting risk in real time, executing investigations end-to-end, and producing regulator-ready outcomes with a complete audit trail.

Our customers see faster case resolution, fewer false positives, lower operational cost, and risk programs built to scale, without sacrificing compliance.

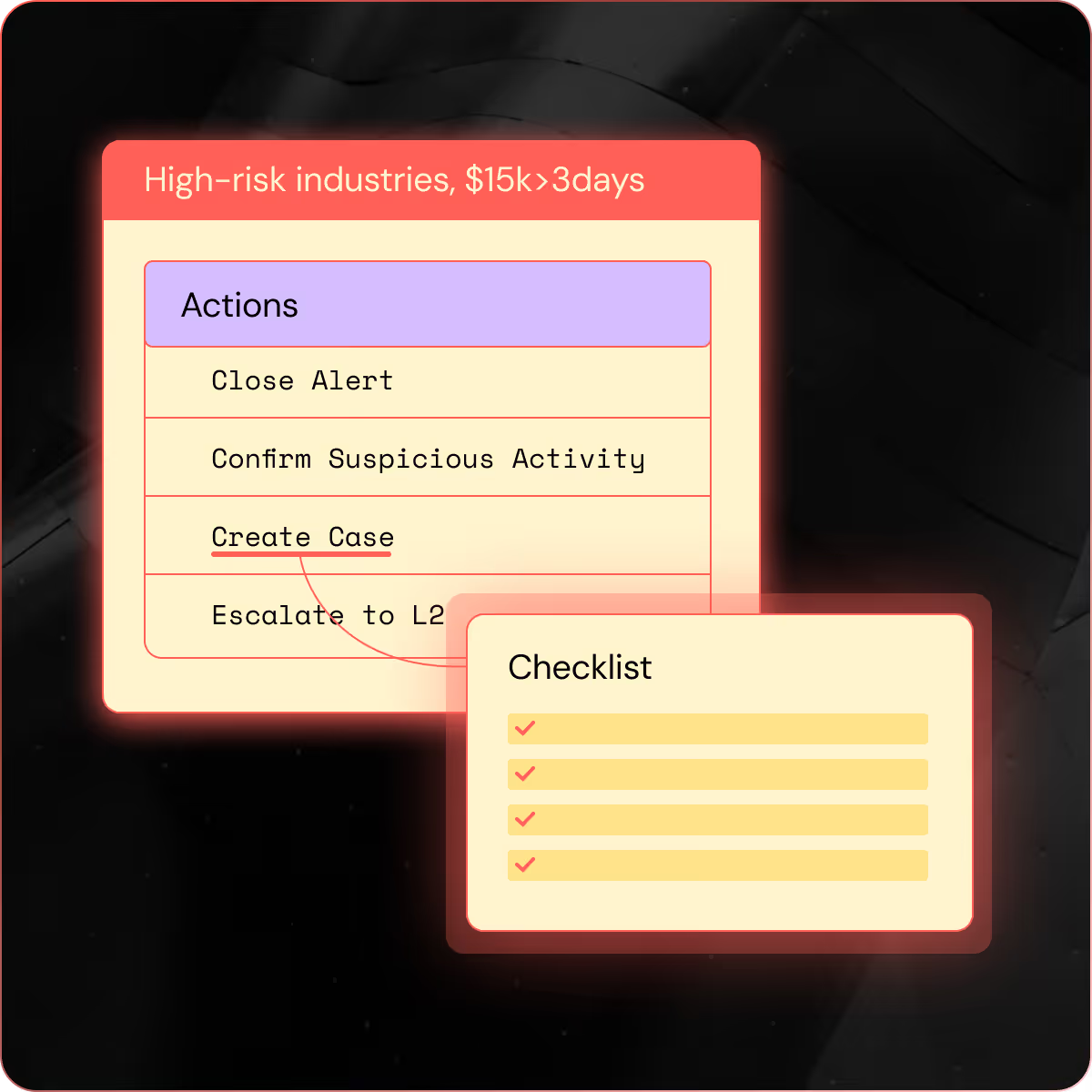

End-to-end lifecycle investigation

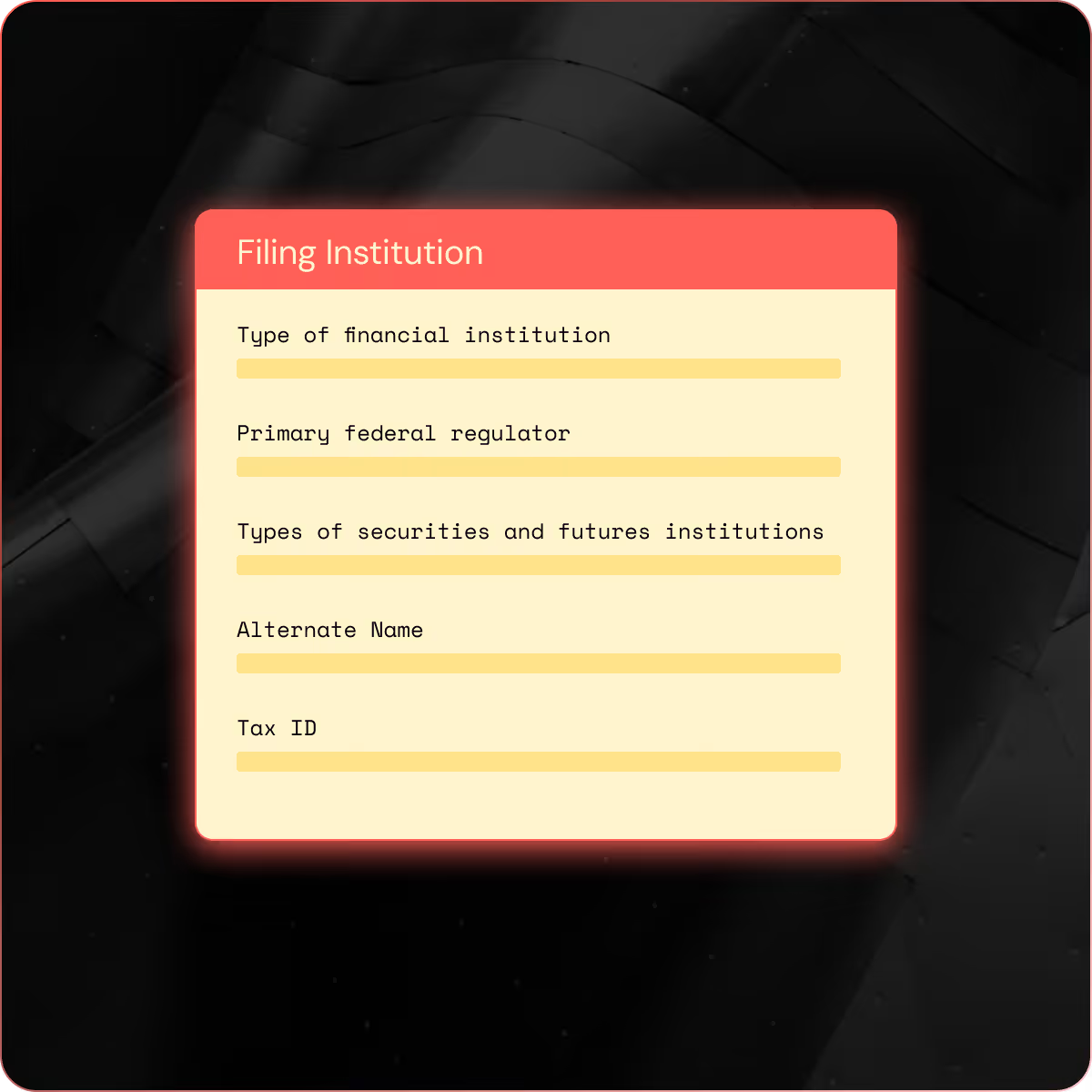

Most systems stop at alerts. Unit21 completes the lifecycle. Our AI agents move from initial signal to regulator-ready filing in a single environment, automating evidence collection, risk reasoning, and narrative drafting. Investigations executed by AI, human-in-the-loop.

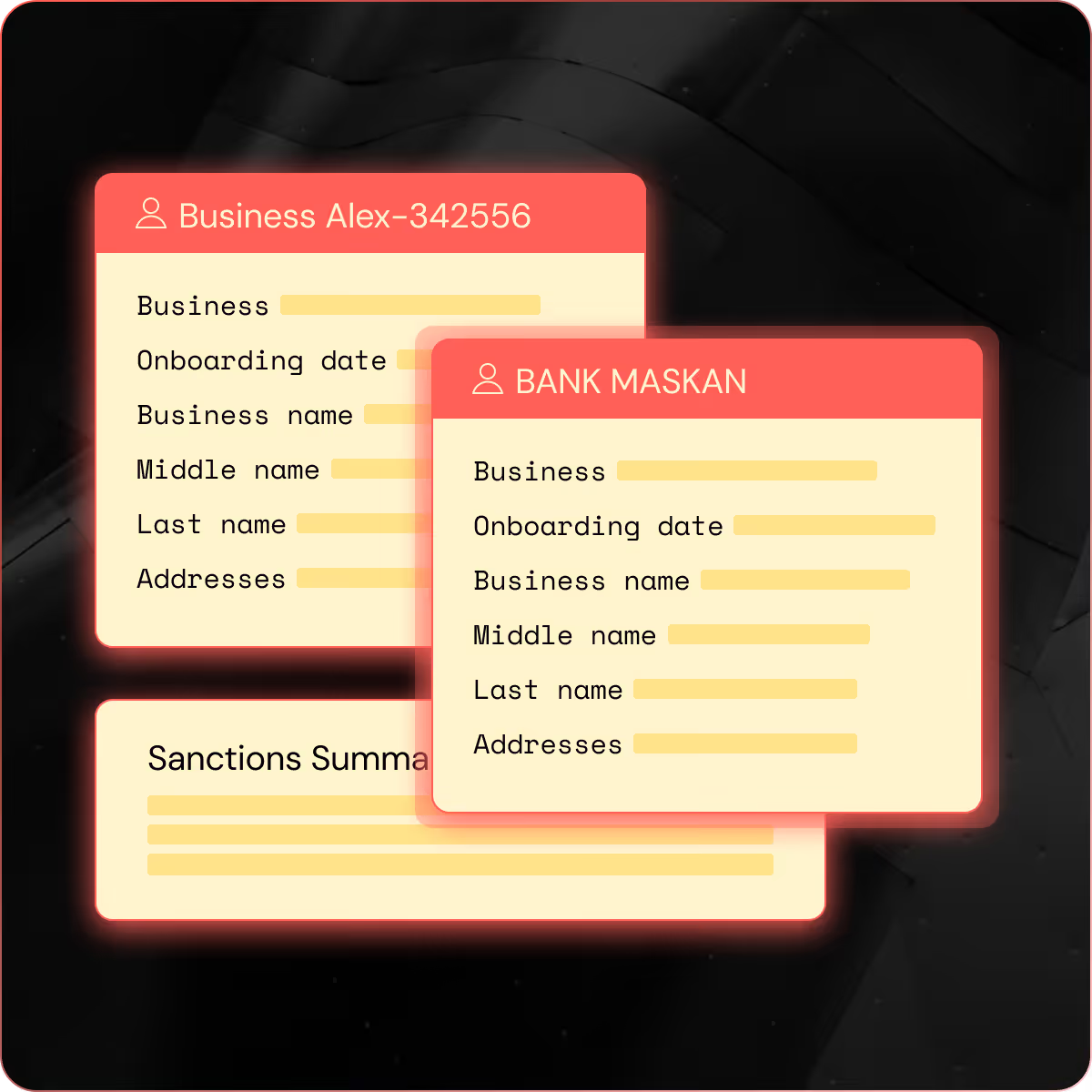

A unified reality for fraud & AML

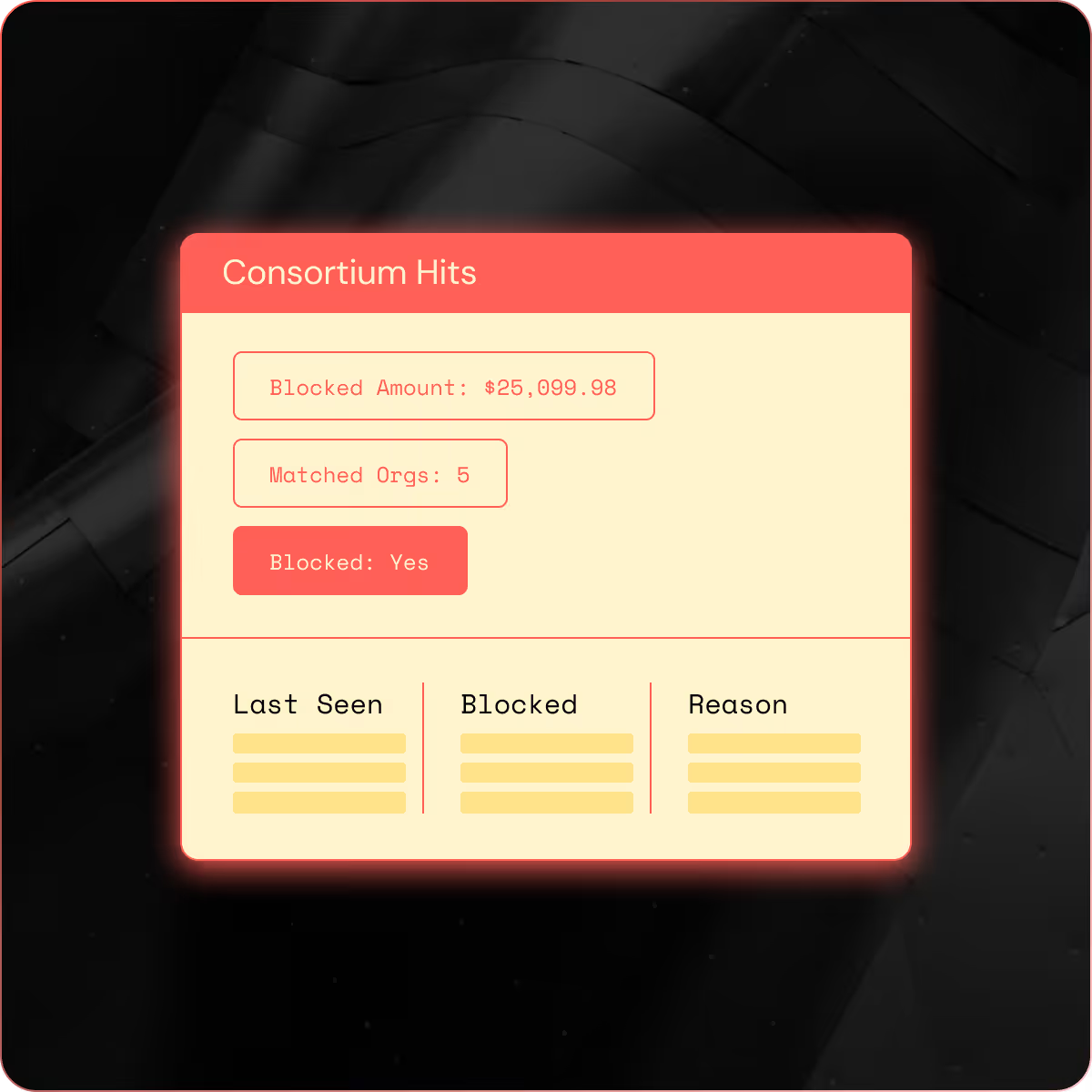

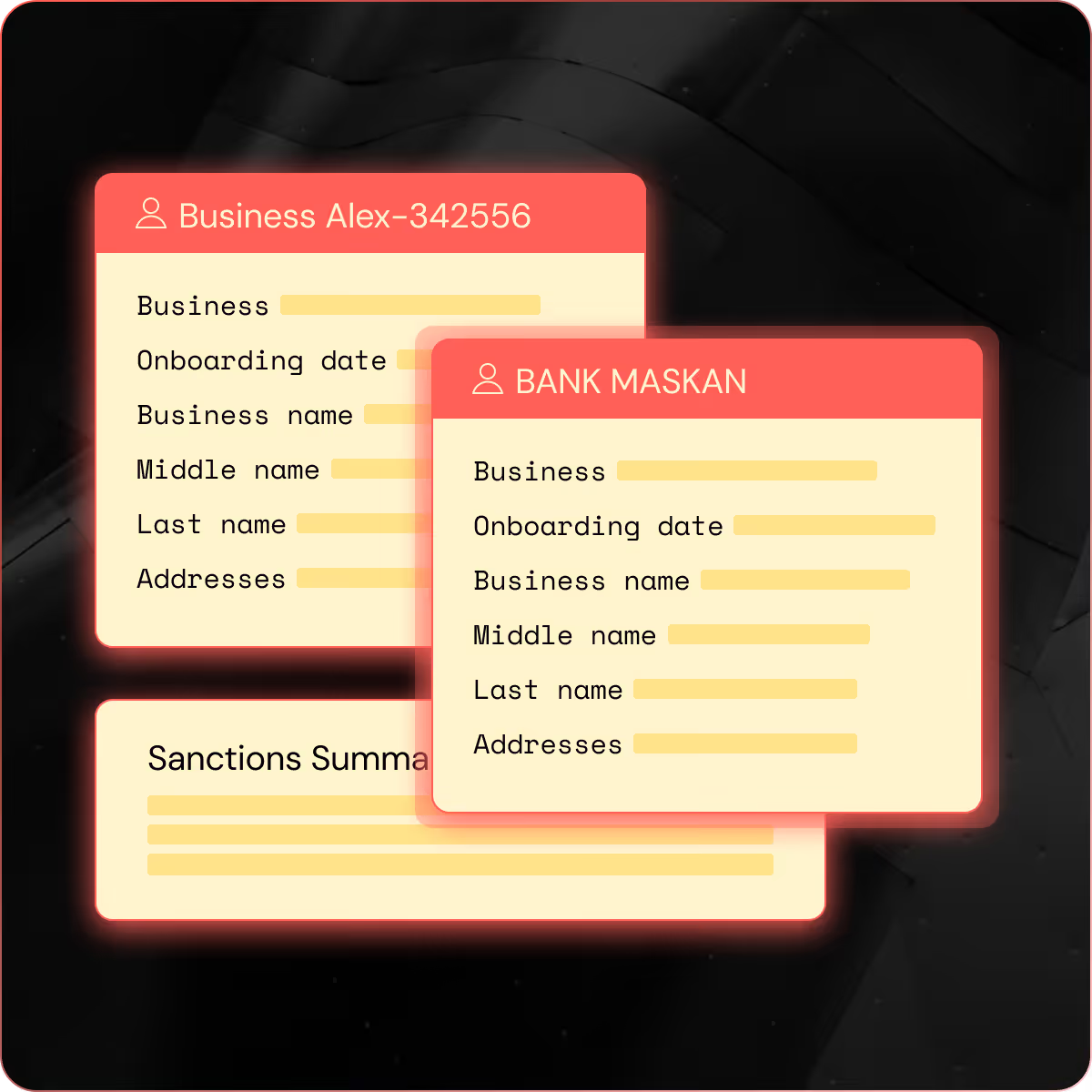

Financial crime isn’t siloed, and your data shouldn’t be either. Unit21 unifies fraud, AML, EDD, and sanctions in a connected data model, transforming flat records into real-time entity networks enriched with behavioral and device intelligence.

Regulator and audit-ready AI

Every AI decision in Unit21 is fully traceable, mapped to your policies, and backed by documented risk reasoning and evidence. You get outcomes and a defensible audit trail built for regulators and your board alike.

Infrastructure built for growth

Fraud prevention and compliance should enable growth, not slow it. Unit21 dramatically cuts review times and reduces false positives, expanding team capacity without adding headcount. As analysts provide the AI with feedback, the system improves with scale.

Automate what you want.

Control what you need.

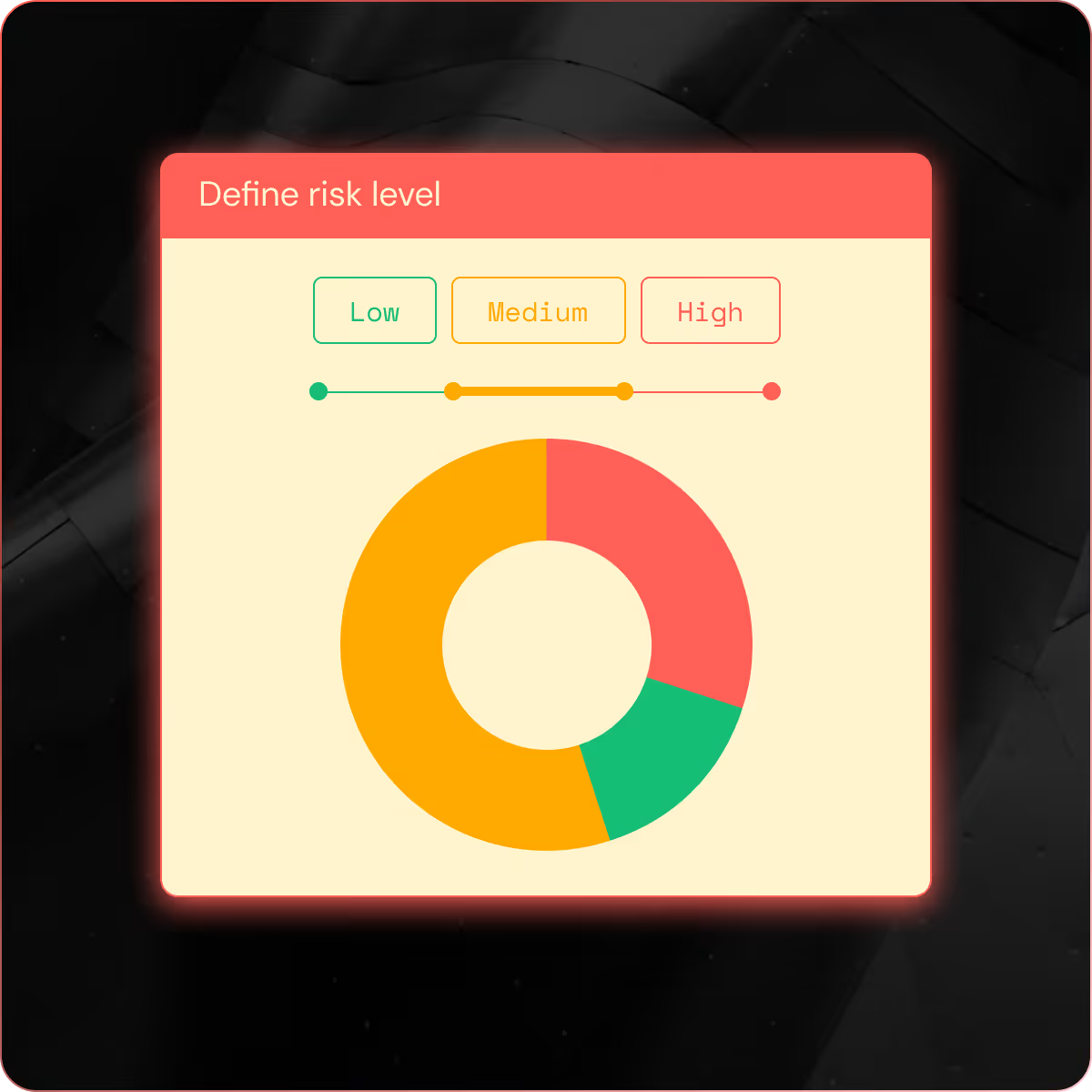

Unit21 is an agentic fraud and AML platform. AI agents run the full loop from detection to investigation, show their work, and improve with every decision, so you can scale safely.

Power your risk operations with agents that automatically detect and investigate in real-time

Unit21’s AI agents perform detection, automate investigations, and continuously learn from alerts, analyst decisions, and historical outcomes to improve risk operations across the entire financial crime lifecycle.

“We’re using AI Agent for L1 alert triage. It’s not about cutting jobs; it’s about scaling responsibly so analysts spend time on true risk.”

Fraud protection built for revenue, not just risk

Protect approvals, conversions, and customer experience while blocking losses in real-time. Unit21 combines device intelligence, graph analysis, and AI-driven investigation to catch fraud before it settles, so you drive growth, not friction.

50% reduction in false positives, improvement in alert quality, & catching 2x the fraud

AI That Runs Your AML Program, End to End

From rule execution and signal detection to investigation, narrative drafting, and regulatory filing, our AI agents orchestrate the entire AML lifecycle in a single place.

Modernized global AML With 57% AI-driven alert automation & 93% reduction in false positives

Supporting the fastest growing & most sophisticated financial institutions

Stop investigating noise.

Start managing risk.

48,299,536

hours saved

in the US