Any business that deals in transactions and transfers understands that a big part of detecting and preventing fraud is following the money. Payment screening helps organizations authorize transactions and make better decisions about whether a transaction may be suspicious—as well as maintain payment compliance.

We explore what payment screening is, why it’s important for financial institutions (FIs), and how the process works. Let’s dive in.

What is Payment Screening?

Payment screening is the process of checking transactions—both incoming and outgoing—to determine if they are risky or violate regulatory standards. The goal is to verify payment information and credentials are legitimate and to identify—and escalate—suspicious transactions for further investigation.

Payment Screening vs Transaction Monitoring

While transaction monitoring and transaction screening (or payment screening) both involve analyzing transactions, they aren’t actually the same thing.

Transaction monitoring refers to real-time or retroactive analysis aimed at detecting and preventing fraud and money laundering. Payment screening refers to customer authentication and verification and is much more associated with AML compliance than it is with fraud detection. With real-time payment services becoming more popular, real-time monitoring and screening is more important than ever.

While transaction monitoring focuses on analyzing customer transaction patterns to identify anomalies that appear to be suspicious, payment screening focuses on customer identity verification and takes into account factors such as the geographic location and devices used by the sender and receiver. It also involves the practice of name screening against sanctions lists.

Payment screening is often conducted at specific moments in a customer’s life (such as when they are onboarded, after ID documentation is updated, etc.), while transaction monitoring is ongoing.

Why AML Payment Screening is so Important to Financial Institutions

For one, payment screening is required for KYC under AML regulations, and failure to comply is punishable by serious financial penalties—and sometimes even criminal—penalties. It’s essential that any organizations subject to AML regulations conduct adequate payment screening.

Few payment fraud and AML processes and tools enable teams actually to stop fraud in its tracks; instead relying on retroactively investigating cases of fraud that have occurred. With payment screening, organizations can actually prevent financial crime from happening, as it allows teams to deny transactions that they deem to be suspicious.

With proper payment screening, companies can significantly reduce their fraud losses, stopping obvious instances in their tracks and avoiding transactions that raise red flags. The more information you have, the more power you have in the fight against financial crime. With that in mind, payment screening should be an essential component of any fraud and AML compliance solution.

The Payment Screening Process: How it Works

At a basic level, payment screening involves authenticating all transaction elements before executing it. It includes checking all parties involved, the nature and purpose of the transaction, and the value of the transaction.

More specifically, payment screening entails the following steps:

- Integrate customer and payment data streams into the system's format to be able to screen the payment, sender, and receiver.

- Monitor, evaluate, and review the data integrated into the system to look for any anomalies or red flags.

- Verify payment information against embargo, sanctions, and politically exposed person (PEP) screening lists, as well as any other blacklists maintained by the institution.

- Observe and analyze the payment information to ensure consistency with the initial KYC onboarding information provided by the customer. For instance, inconsistency between transaction value and the person’s income or source of income can be a red flag.

- Identify red flags or suspicious activity and collate all the data before approving or holding the transaction.

Payment screening solutions verify sender and receiver information against databases to authenticate their identity, cross-reference their names on sanctions lists to avoid doing business with banned individuals and entities, and otherwise screen the transaction for anything suspicious or nefarious.

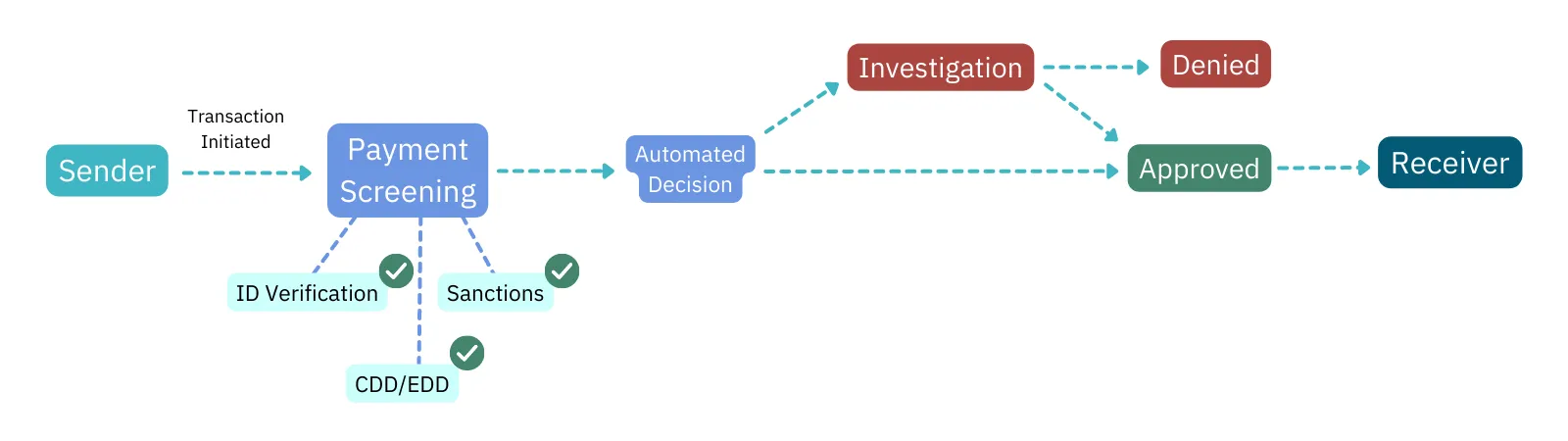

These solutions not only ensure payments comply with national and international regulations, but they automate much of this process. Payment screening is conducted automatically, with the solution making a decision on each case it screens; transactions are then either approved to be completed or flagged for further investigation. A professional will then manually review the case, and decide, either to deny or approve the transaction.

Payment screening is required as part of KYC procedures and AML compliance regulations, and failure to meet proper standards can lead to hefty fines and penalties.

5 Benefits of Payment Screening in AML

Payment screening aims to detect financial crimes at the source, denying them from happening in the first place. This cuts down significantly on fraud losses for the organization, as well as customers (individuals, merchants, and businesses) involved in the fraud.

The process focuses on several specific transaction components, screening them to ensure they were not conducted by restricted parties or in prohibited jurisdictions. Below, we cover some of the main benefits of using payment screening:

- Real-time detection: Payments are screened before authorization, ensuring that incidents of fraud are detected - and stopped in their tracks.

- Identifying anomalies: It assists in identifying anomalies that may require further investigation, assessment, reporting, or transaction monitoring.

- Automating processes: With the payment screening process automated, risk and compliance teams can spend more time investigating cases after they’ve been flagged for suspicious activity.

- Regulatory compliance: It helps organizations fulfill regulatory obligations and comply with AML/CTF regulations.

- Accuracy: Payment screening identifies issues manual procedures may fail to by conducting thorough and accurate checks.

Leverage Payment Screening to Stop Fraud in its Tracks

Criminals are constantly devising advanced methods of avoiding fraud detection systems, so financial institutions need to do everything they can to keep pace.

Payment screening is a crucial process for organizations to meet compliance standards. It’s also one of the few tools that allow teams to stop potentially fraudulent transactions before they are executed, screening for red flags—including non-monetary ones—before processing the transaction.

While payment screening isn’t enough to stop all fraud, it’s an essential component of a larger AML compliance and protection measures organizations should use. When paired with transaction monitoring, organizations will have a clear view of every payment - including any associated behavior - empowering teams to make more precise decisions about suspicious activity.

Check out how Unit21 ensures customer payment screening and real-time risk monitoring. Schedule a demo right away.

Learn more about Unit21

Unit21 is the leader in AI-powered fraud and AML, trusted by 200 customers across 90 countries, including Green Dot, Chime, and Sallie Mae. One unified platform brings detection, investigation, and decisioning together with intelligent automation, centralizing signals, eliminating busy work, and enabling faster responses to real risk.