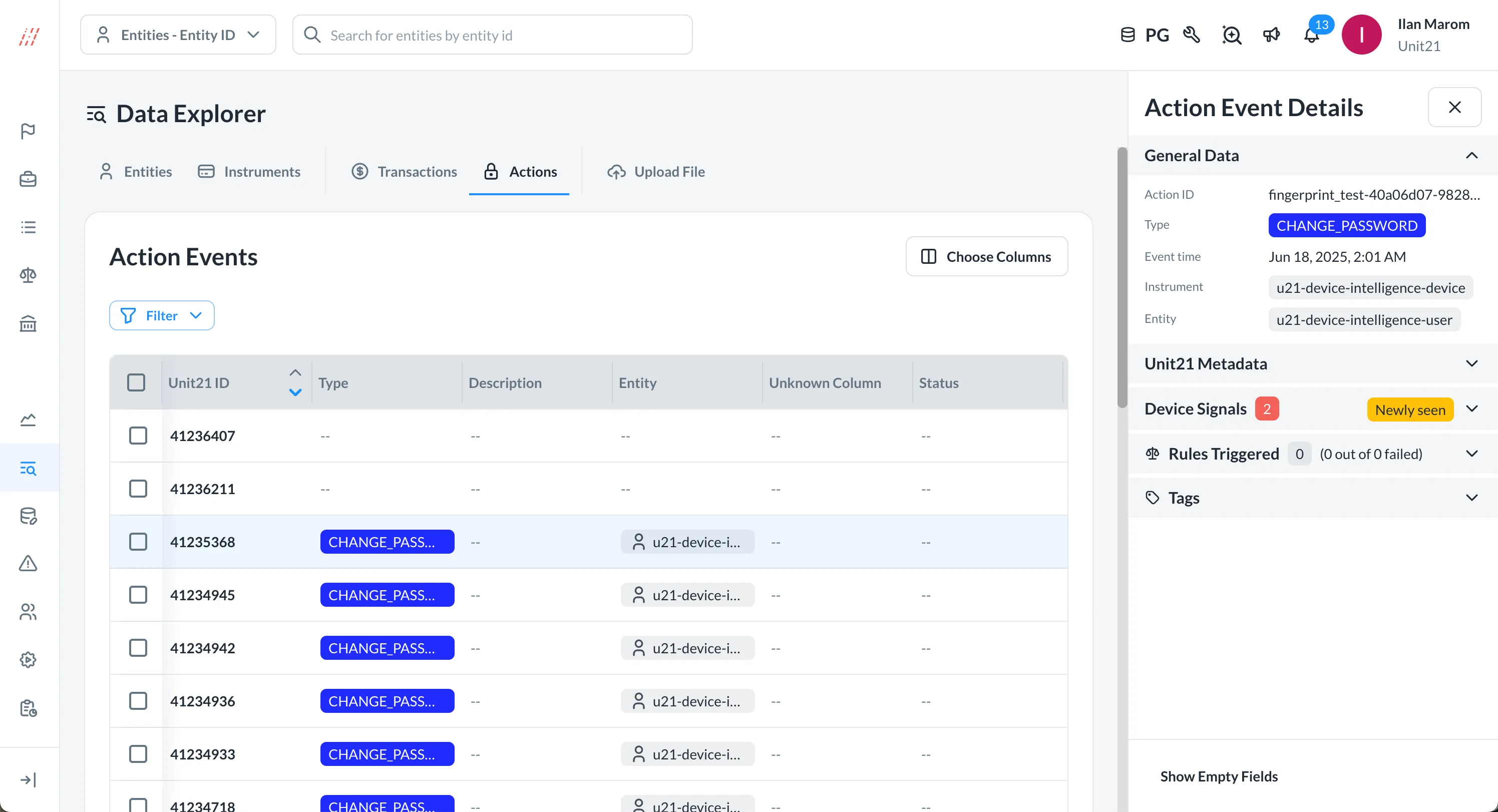

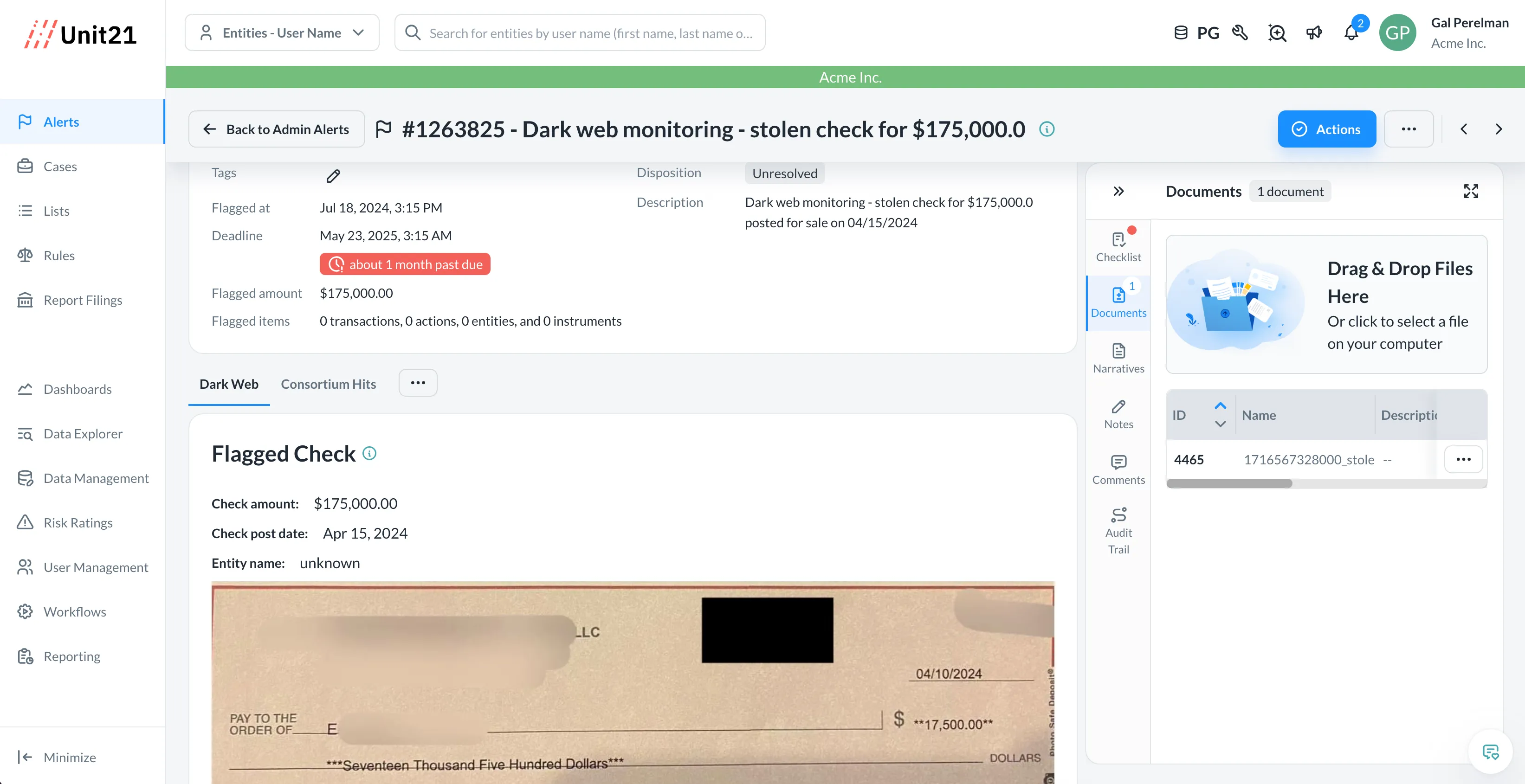

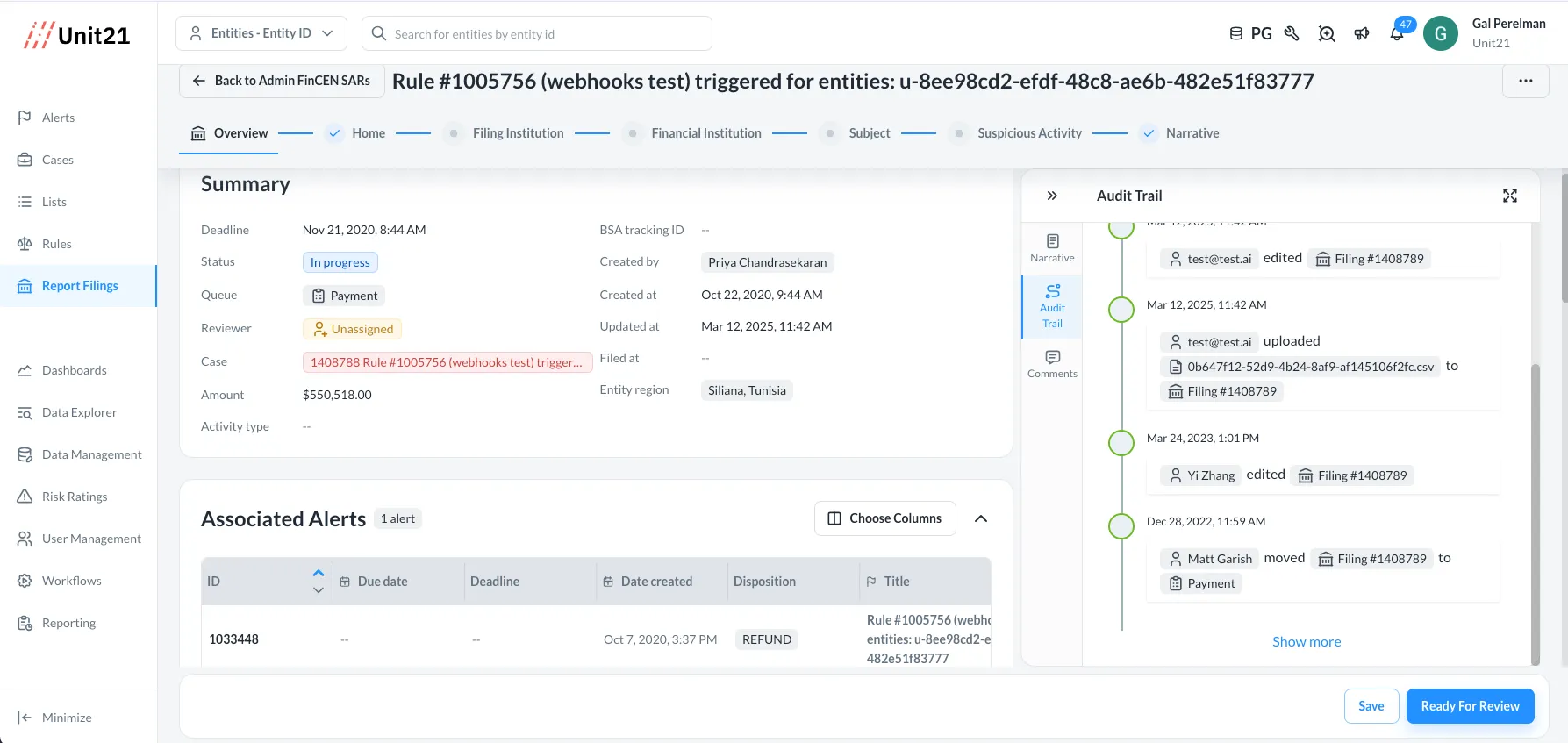

Unified Platform: Fraud + Compliance

One system for alerts, investigations, sanctions, and filings helps you reduce duplicate reviews, missed risk signals, and manual effort.

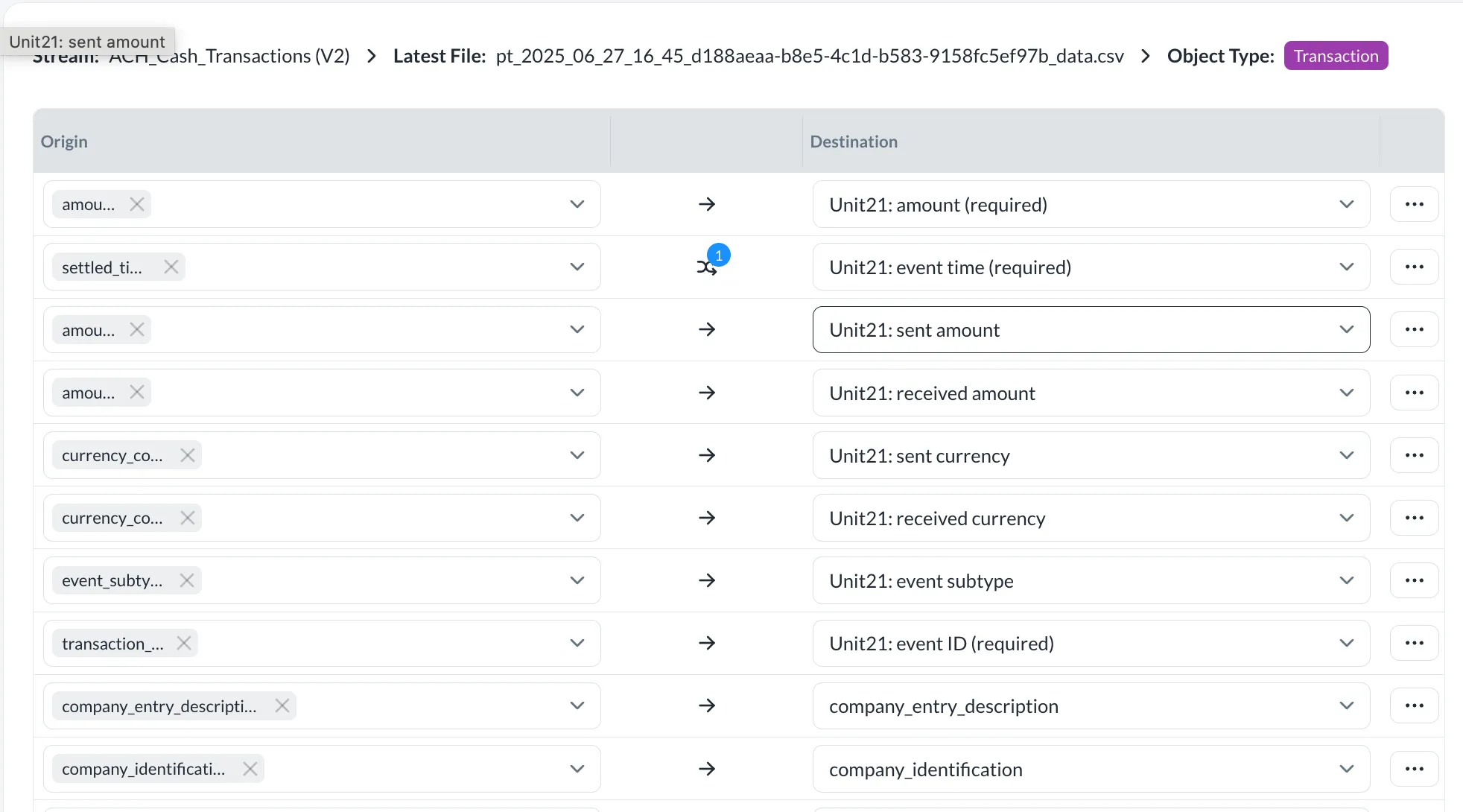

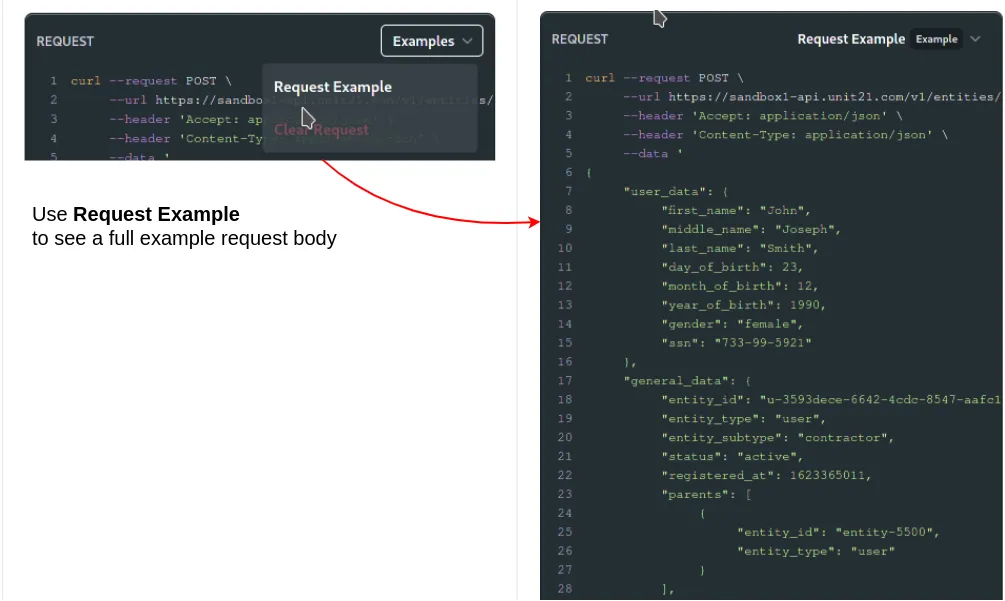

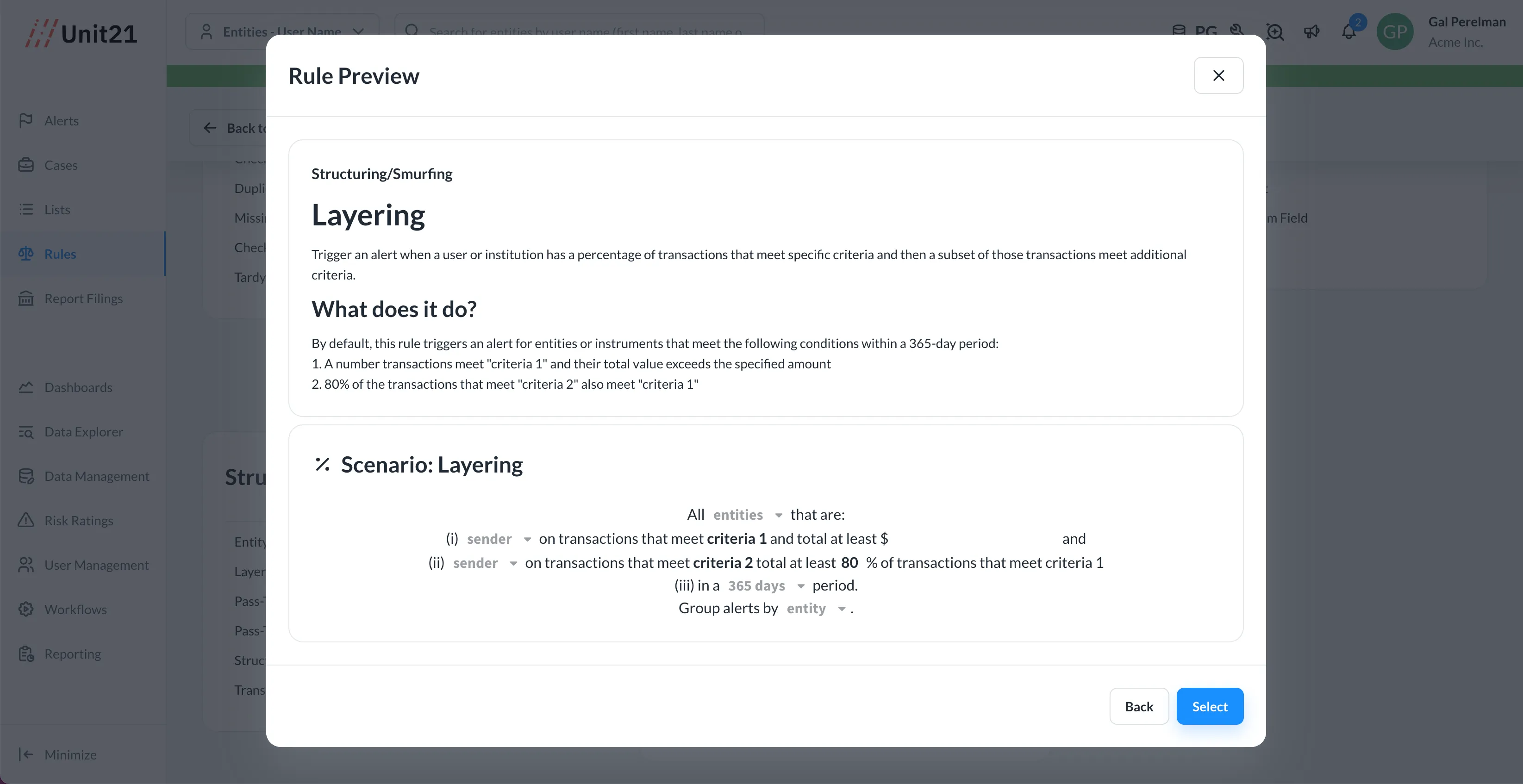

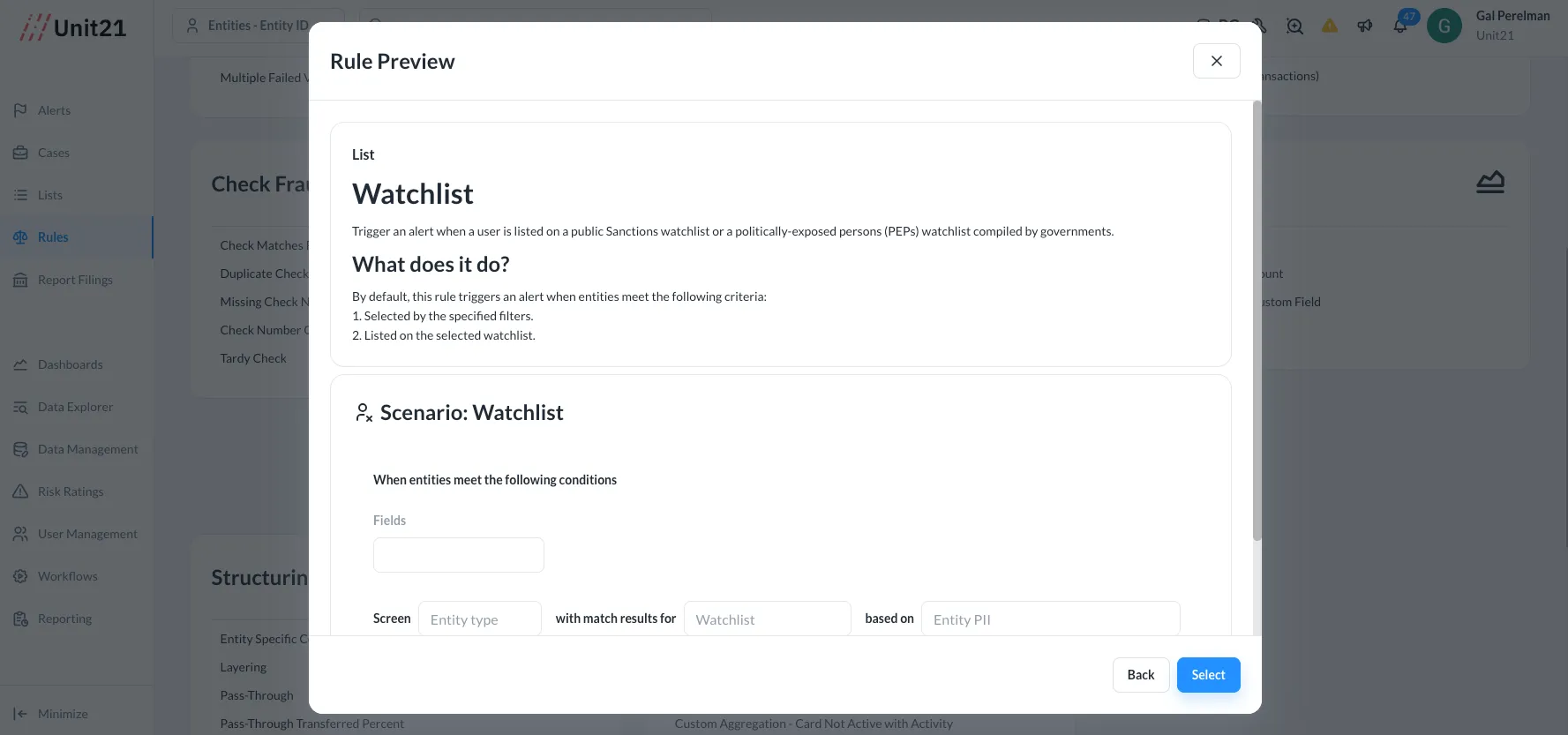

Flexible & Customizable Control

Customizable and flexible rule building gives you full control and visibility that adapts precisely to your evolving business needs.

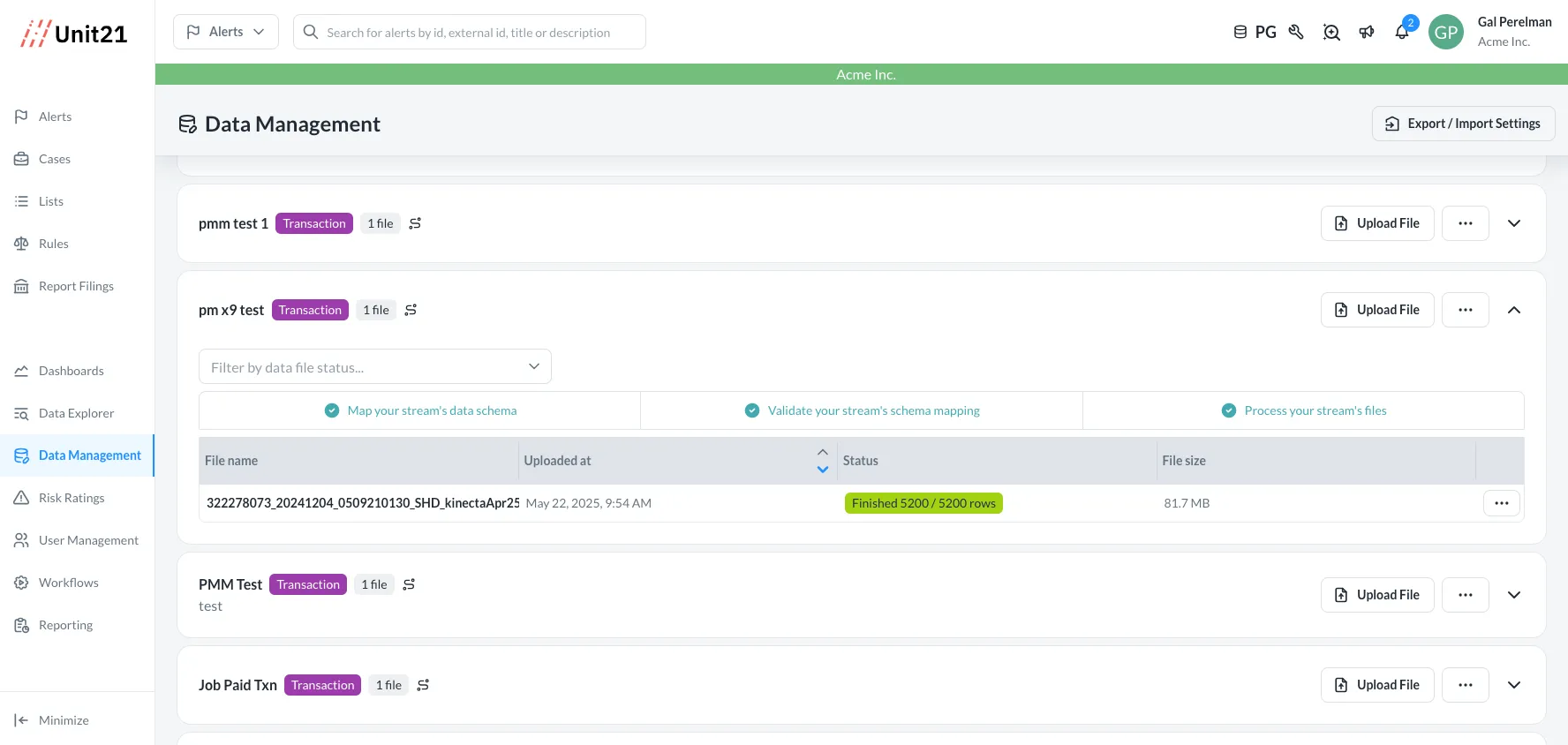

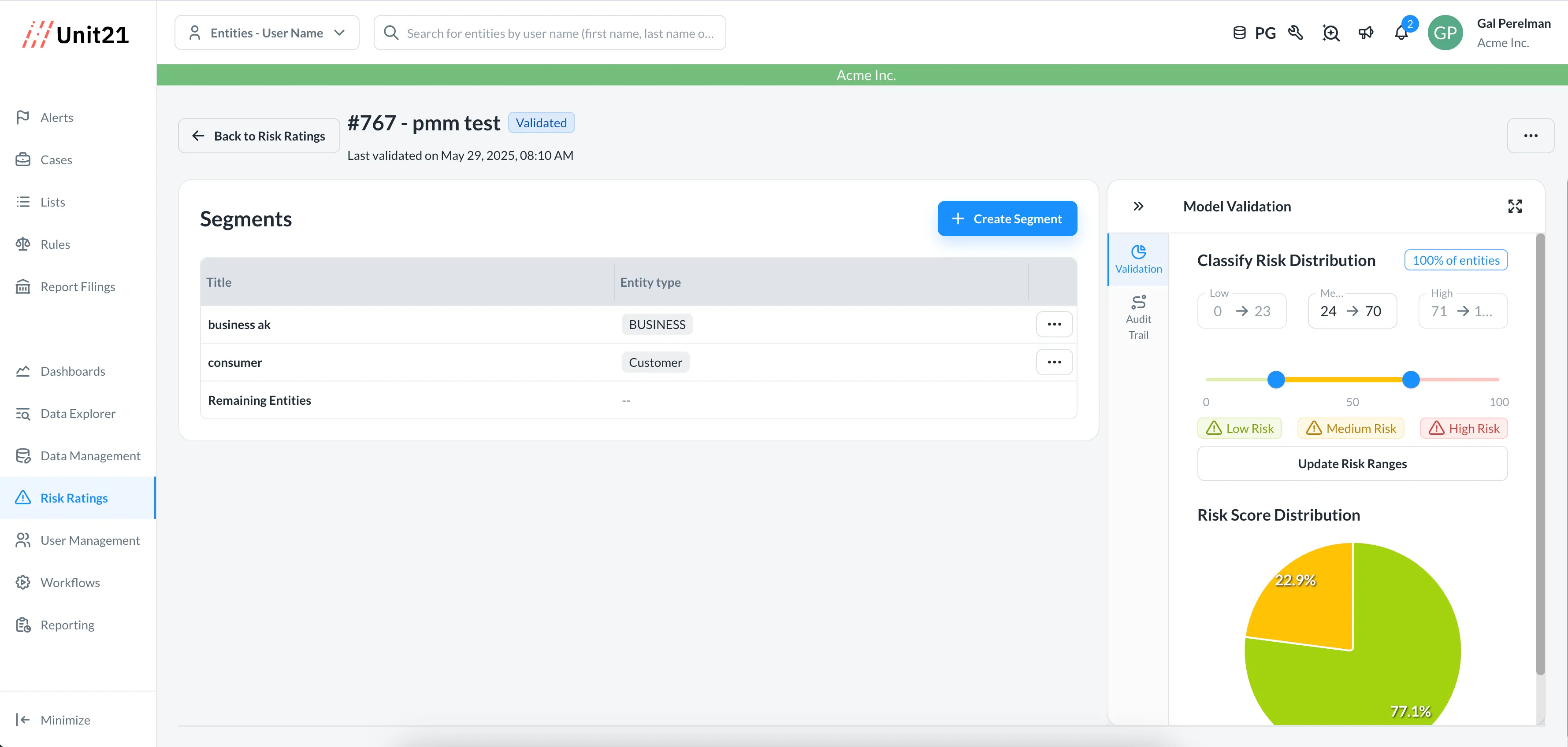

Designed for Unprecedented Scale

Built to support growth and scale, offering a truly not rigid solution that's designed to grow with you, powered by intelligent automation.

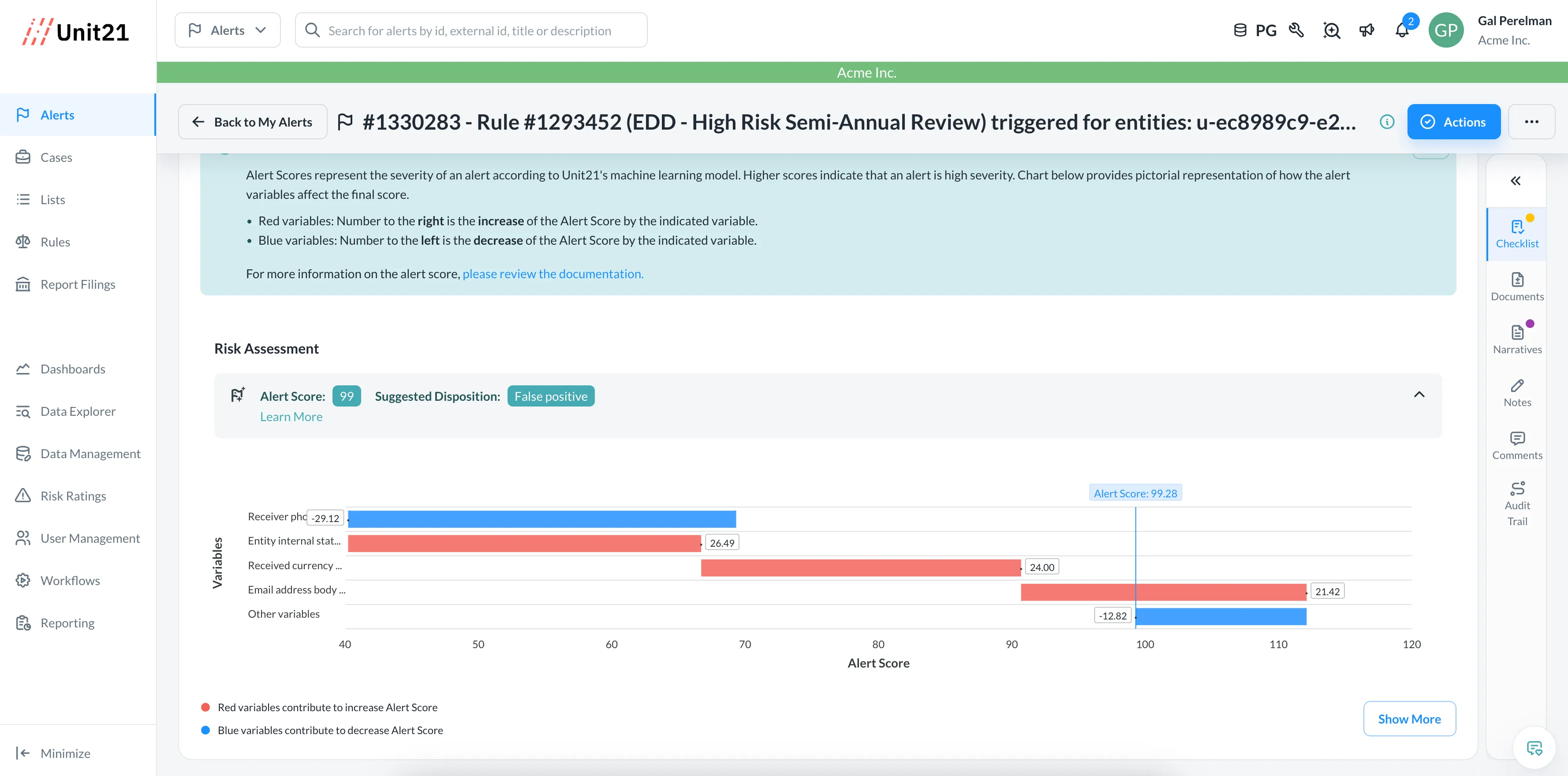

Unwavering Confidence & Explainability

Explainable AI provides clear insights into every decision, ensuring transparency for your team, partners, and regulators.

.webp)