New technologies - Fintech, Regtech, and Suptech - are driving the financial industry forward, challenging traditional banking systems in the process.

While all three of these are closely related - and complementary - solutions in the financial services space, they are not to be confused as the same thing.

To help you distinguish them from each other and ensure you know how to use each properly, we’re going to break down their similarities and differences.

Fintech, Regtech, and Suptech are all components of a complete risk and compliance program, each offering unique capabilities and functionality. To help you understand what each of these are and how they are related, we cover the following:

By the end, you’ll see how Fintech, Regtech, and Suptech are all essential components of a complete risk and compliance program, each offering unique capabilities and functionality for your fraud and AML teams.

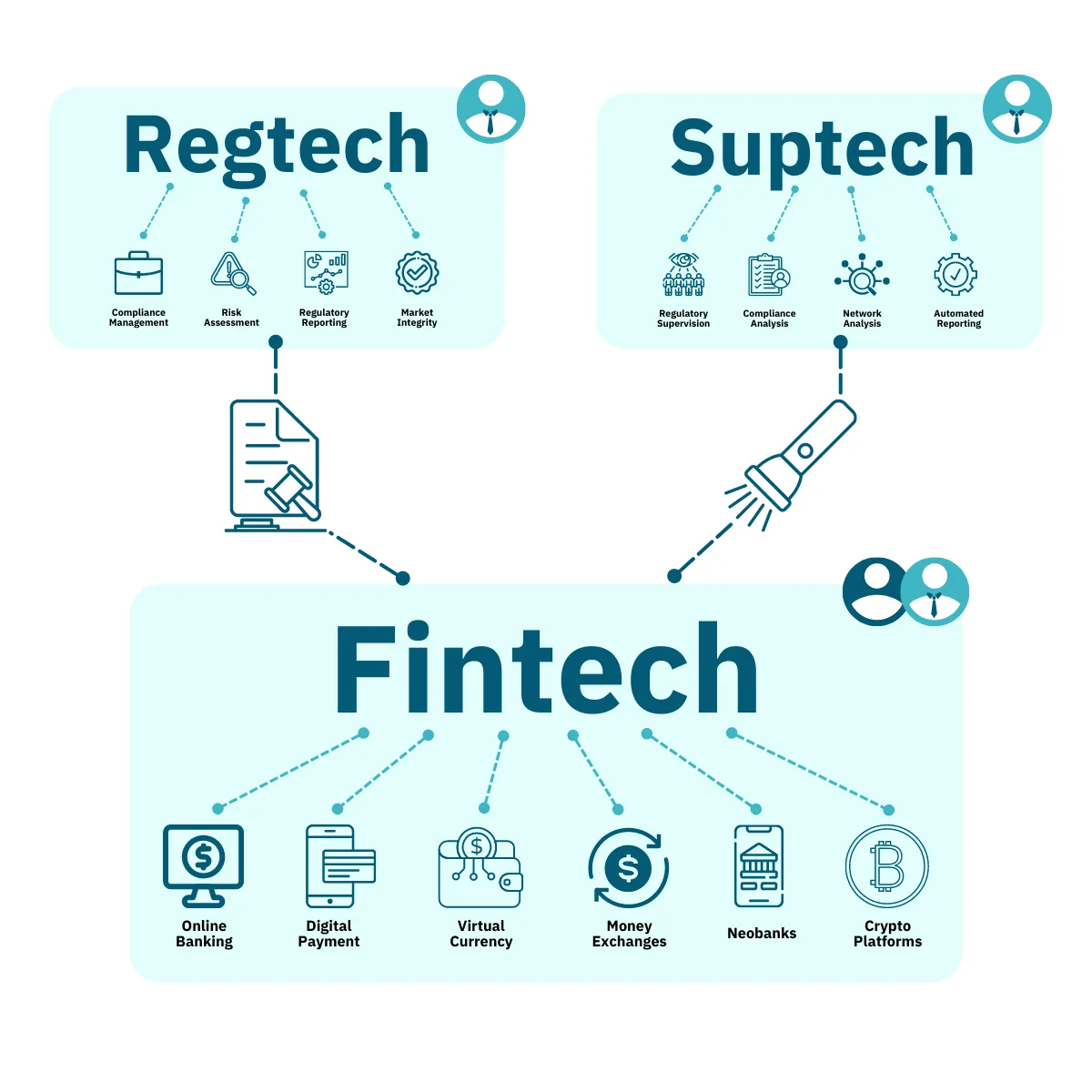

While Fintech, Regtech, and Suptech are very closely related - and sometimes difficult to distinguish from each other accurately - they are actually very different. Here’s a resource to help you understand which is which at a glance:

To illustrate this further, let’s look at how they are related, and some common tools and use cases of each type of solution:

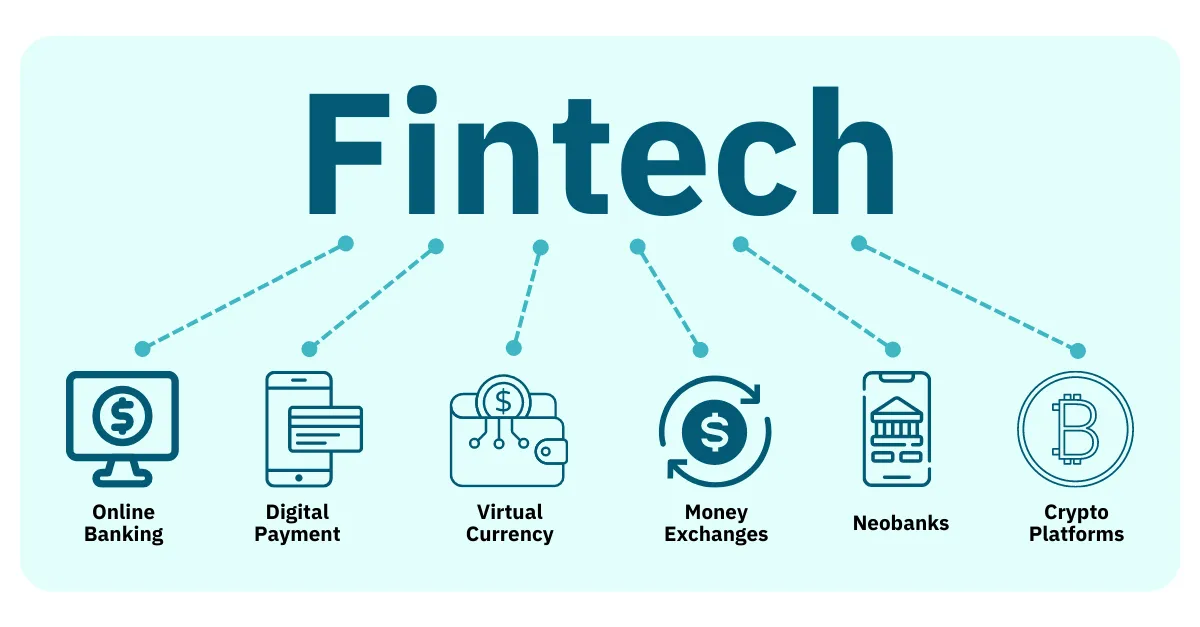

Fintech, short for “financial technology,” refers to any technology and software that is used to enable, support, and optimize financial services. It’s used to streamline complex financial processes, making them more accessible and convenient for users and easier to manage by risk and compliance teams.

Fintech solutions can be business-facing, consumer-facing, or both. With a mix of B2B and B2C use cases, Fintech services can be very different in terms of the services or niche they specialize in.

More broadly, the term Fintech is commonly used to refer to the Fintech industry as a whole, which encompasses digital financial services. Since Fintech is a fairly broad term, there are several different solutions that fall under that umbrella, including Regtech software, compliance software, and digital banking services such as neobanks and crypto platforms.

How Fintech is Different

Fintech is aimed at providing innovative, disruptive technologies that change the way customers engage with financial institutions, offering convenient, online services. It’s a direct competitor to traditional banking, and is rewriting how customers think of banking and financial services. This banking model empowers users with faster, more efficient financial services that use a customer-centric approach.

Why We Need Fintech

Fintech is a disruptive technology that is revolutionizing the financial industry, shifting focus towards a customer-focused approach that centers around accessibility, convenience, and ease-of-use. Competition drives innovation, providing consumers better banking service options that are geared towards their specific needs and financial behavior.

Fintechs have improved financial inclusion by making services more accessible and simple to use around the world. They also offer cost-effective alternatives to traditional banks, with lower service fees and higher interest rates.

When to Use Fintech

Fintech can make risk management easier for businesses and all participants in a financial ecosystem by saving them from equipment failure, data breaches, cyberattacks, and even natural disasters. It can track business activities in real-time, provide data-driven predictions, and monitor financial and operational performance to aid decision-making.

These solutions are ideally suited for automating financial services for both customers and companies. Risk and compliance solutions help teams prevent fraud and manage their AML compliance program by streamlining and optimizing operations.

What Fintech Regulations to be Aware of

There is no universal framework that governs Fintech. Instead, Fintechs are subject to a variety of regulations based on where the company is headquartered and the regions where it operates. In most cases, the organization will be subject to restrictions in both places, and restrictions can apply at national, state, city, and regional levels.

It’s the responsibility of the FI to know - and follow - the applicable regulations. Not only does it save organizations from hefty fines and penalties, but it also builds credibility and trust with customers.

Below are some of the common regulations Fintechs should be aware of (based on where they operate):

Fintechs in the United States:

- Bank Secrecy Act (BSA)

- Anti Money Laundering Act (AMLA)

- USA Patriot Act

- Electronic Fund Transfer Act (EFTA)

Fintechs in the United Kingdom (UK):

- Financial Services and Markets Act 2000 (FSMA)

- Proceeds of Crime Act 2002 (POCA)

- Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017)

Fintechs in the European Union (EU):

- General Data Protection Regulation (GDPR)

- EU Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) rules

- Revised Payment Services Directive (PSD2)

It’s extremely critical for companies to know which regulations apply to their Fintech, and to work closely with a partner or sponsor bank to make sure they know all the regulations that will apply.

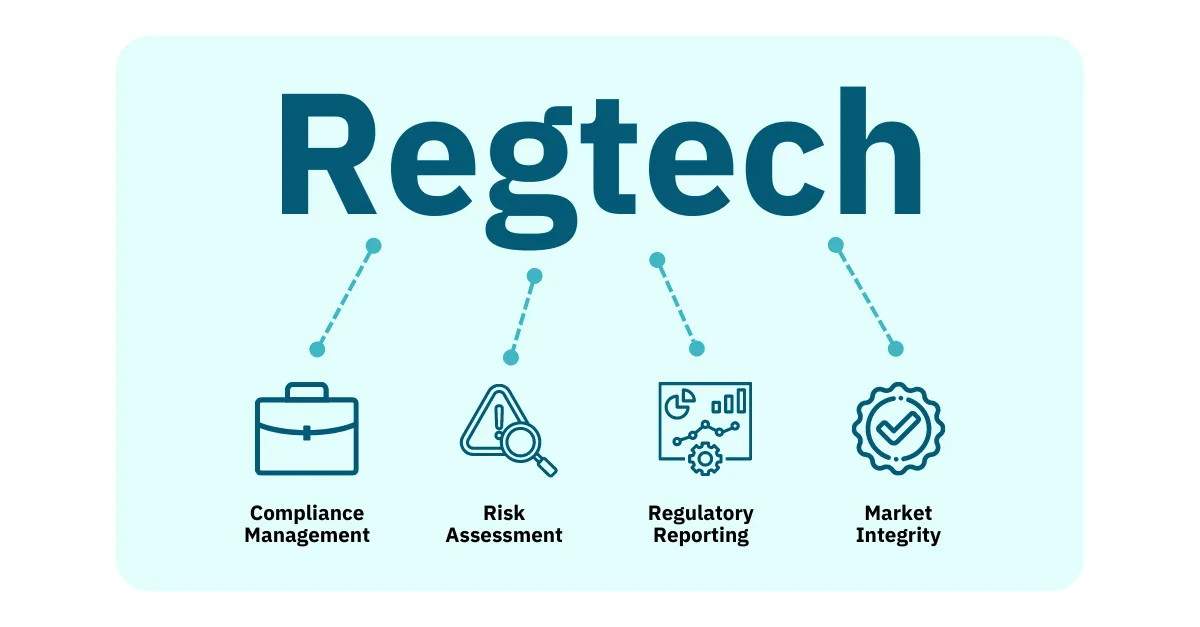

Regtech, short for “regulatory technology,” refers to solutions that optimize and manage regulatory processes and operations. These tools keep Risk and Compliance teams apprised of regulatory requirements, automate workflows related to compliance, and improve risk management.

How Regtech is Different

Regtech is its own branch of Fintech, specializing exclusively in the automation, management, and optimization of regulatory compliance operations within an organization. Regtech solutions are designed for AML businesses, so they can effectively monitor and manage regulatory processes.

Regtech and Suptech are closely related, and both typically help with administrative processes related to regulation, including data collection, reporting, data management, and virtual assistance.

Why Regtech Is Needed

In an industry with rapidly changing regulations, it’s extremely challenging to stay compliant. Regtech not only implies regulatory compliance processes, but it also saves time and effort by keeping teams aware of new changes to applicable regulations. These tools help firms manage and navigate a complicated regulatory environment, saving money on fines and penalties they’d otherwise incur.

Regtech solutions shorten the time it takes for organizations to be fully compliant after a new regulation is implemented or updated. Depending on the tool, that can include helping them stay apprised of current regulations that apply and optimizing workflows for engineering teams to update the system to be compliant.

When to Use Regtech

Regulatory technology provides technical expertise and support for teams to maintain regulatory compliance. Because of this, they are used by a variety of financial organizations, including Fintechs, neobanks, cryptocurrency exchanges, brokerages, credit unions, and even traditional banks.

They are commonly sought out by firms that operate in numerous locations and need to account for several different regulatory bodies and a multitude of regulations. Regtech solutions can amalgamate these operations and give Risk and Compliance teams a way of handling regulatory compliance from a single dashboard.

But they can be just as useful to small FIs that want to ensure regulatory compliance and need to optimize their operations as much as possible to avoid having to grow their Risk and Compliance team. Regtech is a great way to get more bang for buck when it comes to staying compliant.

Overall, Regtech applications have a number of benefits, including consumer protection, anti-money laundering, and even fraud prevention.

Typically, Regtech is best used for:

- Identity verification and management

- Regulatory compliance and change management

- Regulatory reporting and case management

- Risk analysis and management

- Anti-money laundering compliance and detection

For more on how to use Regtech, see our complete article on Regtech use cases.

What Regulations to be Aware of with Regtech

Technically, regulatory technology doesn’t follow regulations itself, but instead helps Fintechs and other financial services businesses adhere to regulatory requirements. Regtech can be used to keep a financial service (such as a Neobank or Fintech) compliant with all necessary AML regulations.

Some of the most important regulations to follow in the US are:

The most pertinent regulation in Europe is the General Data Protection Regulation (GDPR). The top regulators to pay attention to in the UK are the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

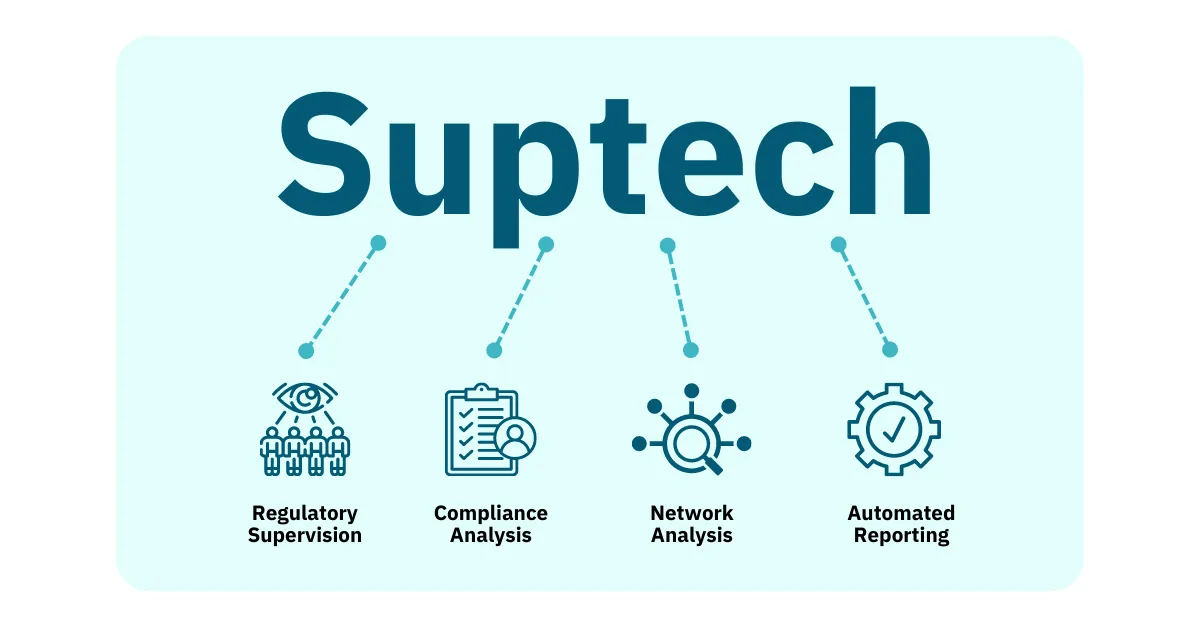

Suptech, short for “supervisory technology,” refers to software that automates, improves, and otherwise manages supervisory processes and operations. In the financial service industry, it refers to solutions that facilitate oversight and administration regarding regulatory compliance.

How Suptech is Different

Suptech is essentially ‘Regtech for supervisors’; it is still focused on regulatory compliance, but it’s designed to help supervisors monitor whether companies are properly following regulations. While Regtech is often used by financial institutions and is still designed for businesses, Suptech is used by regulatory bodies that are attempting to ensure regulations are being met.

Why Suptech Is Needed

Suptech is revitalizing financial reporting, which was previously done periodically (annually, quarterly, monthly, and perhaps bi-weekly). Supervisory technology reduces reporting time, increases data granularity, and amalgamates data into a single place for easier analysis and review. All of this improves the amount of information supervisory bodies have - and increases how quickly they can process - and act on - this information.

When a new fraud scheme emerges, Suptech can be used to ensure supervisory agencies are aware of it. Not only that, but they can determine how frequently it’s occurring, how often it’s successful, and more about the behavior of the fraudsters involved. With more information than any single financial institution (due to a wider sample base), it can better identify fraud trends. This information can then be leveraged to develop best practices to prevent this new type of fraud, which can then be communicated to organizations that could be exposed to the new risks.

In this way, Suptech helps supervisory agencies achieve their objective of promoting trust in financial institutions and markets.

When to Use Suptech

Suptech allows financial authorities to update what was a monotonous, time-consuming process. Suptech solutions enable more efficient data collection, more detailed data analysis, and greater accessibility and ease-of-use. They allow teams to automate what previously had to be done through on-site visits and audits; now Suptech can simplify auditing (and cut down operational costs) with detailed reporting and analytics.

Suptech applications can identify signals of emerging risk in the financial system, allowing financial agencies to communicate these risks to the Fintech market as a whole. Some solutions measure the totality of registrant filings and assess market sentiment. This allows regulators to paint a clear picture of the state of the industry, and help organizations navigate the biggest challenges they face.

What Regulations to be Aware of with Suptech

Since Suptech is a supervisory technology that is related to following regulations and staying compliant, Suptech itself doesn’t have specific regulations to follow. However, it’s closely related to helping fraud and AML teams follow compliance regulations.

In this sense, Suptech itself doesn’t have to adhere to specific regulations. That being said, when using Suptech, it’s critical to be aware of regulations - especially to effectively use the supervisory tech.

The relationship between all three of these can be a bit confusing.

A good way to remember how they relate is to keep in mind that both Regtech and Suptech refer to two types of technology that span across a variety of different industries - one of which is financial services.

Alternatively, Fintech refers to technology related specifically to the financial services industry - and only that industry. This means that both Regtech and Suptech solutions within the financial services space are also technically Fintech solutions; similarly, Fintech solutions that perform regulatory or supervisory functions would be classified within Regtech and Suptech (respectively).

Since financial services are subject to intense regulation and oversight, both Regtech and Suptech solutions are ideally suited for the Fintech space, and are therefore commonly used by Fintechs like neobanks and crypto exchanges.

They go hand in hand, with Fintech solutions pushing the boundaries of financial service capabilities and options, and Regtech stepping in to ensure these tools meet necessary regulatory requirements.

Since their creation, Fintech, Regtech, and Suptech have been used together, and it seems that will be the case for several decades.

Key Observations: How to Use Fintech, Regtech, and Suptech for Risk and Compliance Management

To effectively manage your risk and compliance program, you’ll want to use a solution that ensures regulatory compliance. That way, you’ll never have to worry about fines or penalties for failing to comply with AML regulations - and you’ll be properly prepared to handle money laundering cases. Stay on top of anti-fraud practices by keeping track of the future fraud trends that will impact your business.

Schedule a demo today to learn how Unit21 can effectively manage your risk and compliance operations. Learn how you can stay ahead of the curve by relying on a comprehensive solution that aids your fraud and AML program.

Subscribe to our Blog!

Please fill out the form below:

Learn more about Unit21

Unit21 is the leader in AI-powered fraud and AML, trusted by 200 customers across 90 countries, including Green Dot, Chime, and Sallie Mae. One unified platform brings detection, investigation, and decisioning together with intelligent automation, centralizing signals, eliminating busy work, and enabling faster responses to real risk.