The same risk and compliance standards are applicable to traditional banks, small banks, emerging neobanks, cryptocurrency exchanges, and a myriad of other enterprises in the financial services industry.

This has fueled the need for dynamic AML solutions that automate risk management processes, making it easier for financial institutions to monitor customer information and detect abnormal transactions.

Here, we’ll explore AML software basics and the main types of AML solutions that FIs use to perfect their anti-money laundering efforts and operations. The sections in this chapter include:

Let’s jump in with what AML software actually is and what it does for banks, credit unions, and other financial institutions.

Anti-money laundering software is a valuable solution for financial institutions in the battle against financial crime. It includes technologies that are designed to automate, streamline, and optimize mundane compliance tasks to help organizations comply with required AML regulations.

All financial institutions face money laundering risks and are required by law to manage regulatory compliance. In today’s rapidly evolving environment, traditional, manual methods of combating money laundering aren’t sufficient. Modern FIs, especially Fintechs, leverage artificial intelligence and data science to optimize their AML operations and management, leading to quicker, more agile, and more accurate performance of AML requirements.

The adoption of AML software should be included in a broader AML compliance framework and executed as part of a risk-based approach tailored to the specific requirements of a financial institution. Software may be used to trace and detect massive amounts of unusual activity involving valuable assets as well as smaller, individual transactions.

Anti-Money Laundering (AML) in Banking

Anti-money laundering solutions is essential for almost any institution that handles money. This includes financial institutions like traditional banks, credit unions, small banks, lenders, currency exchanges, and cryptocurrency exchanges and services. But it also includes most payment services, from credit card companies to peer-to-peer digital banking solutions.

The fact is, money launders will look for any method of exchanging money to ‘clean’ their illegitimate funds. According to Zippia, between $800 million and $2 trillion is laundered worldwide each year, costing close to 5% of the globe's total GDP. And since traditional banks dominate the market both in the United States and globally in terms of market volume, they’re still the prime target for fraudsters.

Traditional and manual procedures are no longer useful in today's environment while attempting to combat financial crimes. Every day, criminals come up with new ways to launder money.

Financial crimes continue to be a risk to companies that use manual and traditional procedures. With steep penalties for failing to comply with AML regulations, it’s critical to have a solution to help teams stay abreast of all regulations they need to follow.

Given the complexity of the legal and regulatory frameworks, anti-money laundering software is often a critical and essential part of its AML strategy. Nearly all legislations impose substantial regulatory obligations, demanding external audit procedures, and reporting requirements.

Accurate customer authentication and due diligence procedures are mandated under the US Bank Secrecy Act, the UK's Money Laundering Regulations (2007), the EU's Anti-Money Laundering Directive (2017), and other statutes that safeguard financial institutions.

Recent cases of money laundering, like Danske Bank’s recent $2.1 billion settlement, demonstrate the impact AML failures can have on a financial institution. It’s important to note that regardless of intent, inadequate AML controls due to neglect still leave FIs exposed to serious liability, leading to substantial fines and even criminal culpability.

Traditional AML Solutions

A traditional approach to managing and monitoring AML regulations can weaken AML compliance programs and leave them vulnerable to failure. AML software that leverages KYC processes and high-quality transaction monitoring can help organizations verify customers, flag suspicious transactions and behavior, customer screening sanctions and PEP lists, and even mitigate false positives; plus, they can do it faster and more effectively than manual processes.

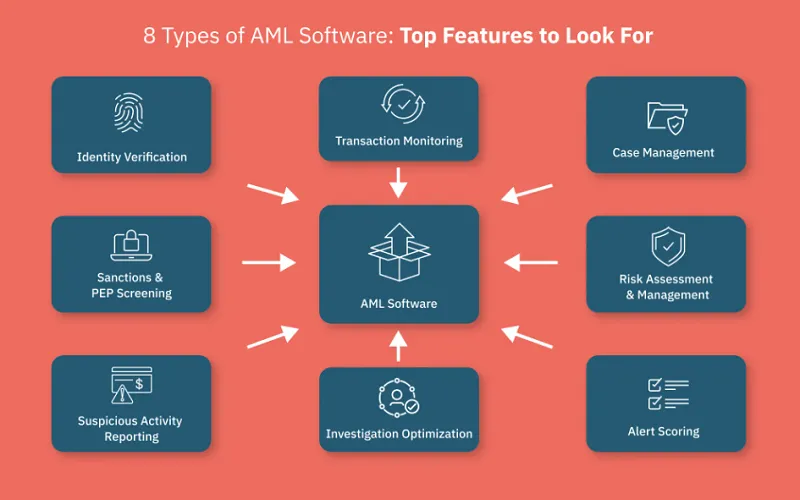

While AML compliance software helps organizations manage their AML program, there are a number of specific tools that perform different functions. To help FIs choose a solution that will help them optimize their AML compliance operations, we explore the different AML compliance tools in detail.

There are a variety of tools and solutions available for compliance operations to run accurately and efficiently. We cover the different tools that banks, credit unions, Fintechs, and other financial institutions require for this in detail below.

1. Identity Verification

Who uses this: Analysts

Identify verification tools authenticate customer information (whether that be an individual or a business). They collect the customer’s name, location, and other identifying information, as well as understand the nature of the business relationship. Typically, they leverage KYC or KYB databases to ensure that they know a customer is who they say they are before engaging in a relationship with the customer.

As per regulatory requirements, businesses must take the necessary procedures to determine and verify each customer's unique money laundering and terrorist financing risks. In order to ensure the KYC process is thorough, due diligence is performed on the perceived level of risk or new customers using one (or both) of the methods below:

- Customer Due Diligence (CDD): CDD is the fundamental process of obtaining information on potential customers to create a comprehensive picture of their identity and risk level.

- Enhanced Due Diligence (EDD): When a consumer is identified as high-risk under CDD, an additional level of investigation, called EDD is carried out. EDD pays closer attention to prospective clients who are more likely to engage in financial crime, such as money laundering or supporting terrorism, given the nature of their business activities.

Digital identity verification can be used by businesses to quickly identify and verify their customers. Biometric or facial recognition, digital forms of identification, and other methods such as liveness checks, one-time passcode authentication, or database checks are some of the few ways to enable the verification of digital identities. In-person customer verification is practically impossible with international customers. Digital identity verification helps secure your company and comply with regulations.

Criminals are very creative and adept at leveraging digital avenues to commit money laundering. High-quality ID verification methods, such as KYC procedures and biometrics, can root out malicious actors and stop them from entering your product ecosystem in the first place.

2. Transaction Monitoring

Who uses this: Analysts | Investigators

Despite doing your best to verify customer identities at the point of onboarding, criminals can still get through the cracks. To effectively combat the illegal laundering of funds, transaction monitoring is an essential element of AML procedures.

Transaction monitoring can detect suspicious activity and anomalies in user behavior, flagging these cases for further investigation. This is done with finely tuned rules that generate alerts for behavior that doesn’t align with the user's past behavior or behavior that may be indicative of money laundering.

A staple in AML compliance software, transaction monitoring offers real-time screening of transitions, allowing AML teams to react quickly when suspicious activity occurs. These incidents can then be quickly escalated to the appropriate authority for further investigation. In some cases, transaction monitoring can even stop illicit transactions from occurring in the first place, halting them in their tracks.

3. Case Management

Who uses this: Analysts | Investigators

Once suspicious transactions or users are identified, they need to be investigated and (when warranted) reported to the appropriate authorities. After an alert has been generated, each case needs to be managed, ensuring it gets properly investigated and is reported on time.

Case management is typically the final—albeit long—stage of any successful fraud and AML system. It usually marks the final touchpoint an organization has with the case, as legal authorities will then take action based on the filing. Analysts are required to review and investigate the incident of suspicious activity and then complete and file a suspicious activity report to authorities.

Traditionally, case management is a time-consuming, manual process that involves prioritizing cases, investigating the activity in detail, and then filling out and filing a report. Fortunately, AML case management software automates much of this process for organizations, streamlining the production and filing of reports. Some of the best solutions will automate report filing, freeing up significant time for risk and compliance teams to do more useful tasks—like investigating cases.

While this workflow may vary slightly for certain industries, most financial institutions must follow a relatively similar process. Case management software helps provide a simple, seamless system for handling, investigating, and reporting cases of illegal activity.

4. Sanctions and PEP Screening

Who uses this: Analysts | Investigators

Financial institutions are restricted from doing business with certain high-risk clients and organizations that are kept on ‘blacklists’ by some jurisdictions, such as the Specially Designated Nationals List of the United States. Sanctions and PEP screening is a vital step in minimizing the risks of conducting business with individuals tied to bribery and political corruption or those who are based in a sanctioned jurisdiction.

Anti-money laundering software cuts out any manual work in this process by immediately identifying and flagging a blacklisted entity. These checks are intended to prevent financial crime and anyone garnering negative or adverse media attention.

5. Risk Assessment & Management

Who uses this: Analysts | Investigators | Managers

Identification, assessment, and prioritization of risks is the first step in risk management, which is followed by a coordinated and cost-effective utilization of resources aimed at minimizing the probability or impact of unfavorable events.

Risk management often entails maintaining a record of all the risks a business faces, assessing these regularly, scoring these risks to determine which threats to prioritize, and creating a risk-mitigation plan to eliminate or minimize each threat. Once data is compiled and evaluated by compliance analysts, a compliance manager oversees the organization's risk management program, detecting risks that could impact the organization's reputation, safety, and financial success. The team then creates measures to reduce or mitigate any unfavorable outcomes.

Organizations in the financial industry require integrated solutions for greater risk insights and decision-making. AML software can help teams develop an effective risk management strategy, identify the biggest threats, and consolidate all this information in a unified dashboard for easy analysis.

6. Suspicious Activity Reporting

Who uses this: Analysts | Investigators

Every time there is a suspected case of money laundering or fraud, financial institutions and those associated with the organization are mandated to file a Suspicious Activity Report (SAR) with the proper regulatory authority. In the U.S., this is usually the Financial Crimes Enforcement Network (FinCEN).

These reports are instruments that ensure suspicious activity is properly investigated and stamped out, and are required for transactions and behavior that could be indicative of criminal conduct, may be a threat to public safety, or appear unusual in nature. Determining what amounts to suspicious activity varies in different countries and regions, but there are typically clear guidelines within jurisdictions about what activity should lead to a SAR.

Suspicious Activity Reports (SARs) are required to be filed under AML regulations, and failure to do so can result in hefty fines and penalties. While these can be done manually, they are often one of the more time-consuming processes in case management (and certainly one of the most boring and repetitive).

Fortunately, case management solutions that automate SAR filing to regulatory authorities like FinCEN and goAML take a lot of the manual work out of this, producing and filing SARs on your behalf. This frees up staff time for more important tasks, like investigating cases.

7. Investigation Optimization

Who uses this: Analysts | Investigators

An AML investigation is a formal investigation of suspicious activities, meant to ascertain whether a customer (whether they’re an individual or an entity) is using the financial institution to launder money. Investigation optimization facilitates the implementation of focused AML and anti-fraud initiatives, minimizing turnaround times and improving task performance.

These solutions not only make investigations themselves easier through the use of unified dashboards, consolidated information, and advanced analytics features, but they also aid with alert prioritization so teams use their time effectively.

Consequently, false positives can be reduced without any valuable data being lost. A business can find solutions very efficiently with more targeted alerts. Though false positives cannot be completely eliminated, minimizing their frequency can assist in boosting performance, building team morale, and cutting operational expenses, all of which have a substantial effect on revenue. The best risk and compliance teams accomplish this using transaction monitoring software that enables rule testing prior to implementation.

8. Alert Scoring

Who uses this: Analysts | Investigators

One of the biggest challenges risk and compliance teams face is improving efficiency. It’s often challenging to marshall resources effectively to root out the biggest threats.

Alert scoring provides a quantitative value (on a scale of 0 to 100) for each incident of suspicious activity, allowing fraud and AML investigators to instantly comprehend the threat level of a case. This system essentially provides a simple means of ranking—and prioritizing—the highest-risk alerts.

More advanced tools use AI and machine learning that allows the system to leverage previous alerts to better predict risk scores, and therefore improve the efficiency of the alert generation system.

Having a user-friendly UX that clearly indicates which alerts need to be prioritized makes it easier for fraud and AML agents to perform their roles, requiring less training and experience to do their jobs.

Alert scoring can even allow organizations to manage cases more efficiently across the team, ensuring lower-risk cases are given to newer analysts, while escalating more complicated, high-risk cases to more experienced team members.

AML violations can have serious consequences for financial institutions, including severe fines and penalties, criminal liability, and reputational damage. When choosing an AML software, the selection process should be thorough, taking into account the consequences for the financial institution and individuals involved.

It’s imperative that a solution meets regulatory requirements, can adapt to the organization’s various and changing demands, and can adequately protect the organization (and its customers) from money laundering threats.

Below, we cover the main criteria to consider before making a final decision.

The revenue and growth of financial teams are impacted by the magnitude, speed, and precision of money laundering. To stay one step ahead of criminals, compliance teams must upgrade their AML infrastructure by investing in AML compliance technology and training materials that enable them to use these solutions effectively.

AML Solutions for Banks and Beyond

AML (Anti-Money Laundering) solutions for banks have evolved to address the growing need for comprehensive money laundering solutions. Financial institutions must implement effective AML software that combats money laundering, reduces false positives, and enhances KYC processes.

Risks and Solutions in AML

Modern AML solutions encompass AML cloud technology, risk scoring, client risk assessment, AML checks, payment screening, PEPs sanctions, and compliance management.

Benefits of Advanced AML Platforms

Adopting state-of-the-art AML platforms provides numerous benefits, including:

- Risk Scoring and Client Risk Assessment: Accurate risk scoring for better client risk evaluation.

- Payment Screening and Sanction Management: Effective payment screening and use of sanction scanners reduce illicit transaction risks.

- Compliance Management: Comprehensive systems help banks stay compliant with regulations.

Anti-Money Laundering Program to Track Fraud

AML technology is a great way to identify and track money laundering activities and suspicious criminals in a way that traditional methods have failed to in the past. The accuracy, convenience, and automation AML technology brings to a compliance team is unmatchable.

PRO TIP:

For more information about selecting AML software, visit our resources about how to select the best identity verification software, how to choose the best transaction monitoring software for your needs, and how to source the right AML case management software.

Choosing the right software is one component of proper AML compliance, which also includes having leaders who are truly invested in AML compliance, and building out a comprehensive program that is followed by all stakeholders within the organization.

If it’s clear what software needs to be implemented within your organization to ensure all aspects of AML are covered, you are probably ready to move on to the next chapter on how to build a successful AML compliance team, where your Compliance Officer will need to take many components of your program into account, including your tech stack.

However, if you want to go back to learn more about what your team needs to be monitoring, revisit our chapter on AML penalties, fines, and sanctions you need to watch out for.

Subscribe to our Blog!

Please fill out the form below:

Learn more about Unit21

Unit21 is the leader in AI-powered fraud and AML, trusted by 200 customers across 90 countries, including Green Dot, Chime, and Sallie Mae. One unified platform brings detection, investigation, and decisioning together with intelligent automation, centralizing signals, eliminating busy work, and enabling faster responses to real risk.

.webp)

.webp)