Money20/20 Las Vegas has a reputation for being one of the most (if not THE most) influential conferences in Fintech.

This year’s event will be held at the Venetian hotel in Las Vegas and is expected to bring everyone from the whole global community together for Fintech’s biggest conversation.

To get you ready for the exciting experience ahead, we’ve created this article to help you understand:

- What to expect at Money20/20 2022

- Fintech trends leading up to the event, and

- Key highlights that you won’t want to miss

Let’s get to it!

What to Expect at Money20/20 2022 in Las Vegas

3 Fintech Trends to Keep In Mind

Embedded Finance

One of the most prominent trends in Fintech right now is the concept of embedded finance.

Embedded finance solutions are built into existing platforms and apps, making it more convenient for users to access financial services. These options make it quick and easy for customers to access financial services while allowing companies to access new revenue streams.

As more and more companies look to embed financial services like embedded payments, embedded credit, and embedded insurance into their existing platforms and products, questions about safety, security, and regulation are at the forefront. Also, many may wonder if embedded finance has reached its peak - more on that in a few minutes.

Either way, this trending topic will find its way into the Money20/20 ecosystem this year.

The Rise (and Demise?) of Neobanking

It is no secret that the neobanking industry has experienced accelerated growth as a result of the pandemic. Recent research from Publicis Sapient states that “of the roughly 240 operating globally in April 2021, more than 20% had launched in the previous 12 months as Covid-19 spread around the world.”

Rather than visit a branch just to wait in line or phone in just for robotic responses, customers want fully digitized banking at their fingertips. Neobanks offer the convenience modern consumers are looking for, and because of that, the use of neobanks by consumers is on the rise.

But individuals aren’t the only ones who see the benefits of virtual banking. According to a report from Bank Administration Institute (BAI), while traditional banks are still leading the charge, many small businesses would change their primary bank to a neobank to access better rates and lower fees.

However, while the global neobanking market is currently valued at approximately $66 billion USD (Grand View Research), there are signs that troubled waters lay ahead. According to Forbes, 2022 marks the end of the neobank era. Neobanks “may have won the first battle with incumbent banks, but a new wave of competition is coming from megafintechs and non-financial brands.”

It is impossible to know how the future for neobanks will play out, but you can be sure that this is a topic that will make its rounds at Money20/20.

Cryptocurrency and Crypto Crime

Crypto adoption has been climbing year over year, therefore, it’s no surprise that more cybercriminals are using cryptocurrency for nefarious purposes. According to Chainalysis, of all the crypto transactions tracked, total transaction volume grew to $15.8 trillion in 2021, which is up 567% from 2020’s totals.

However, based on their reporting, “transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021 despite the raw value of illicit transaction volume reaching its highest level ever.”

On the flip side, an article from CoinDesk notes that organizations like FATF believe that the estimates presented in these reports are too low. FATF stated that, “The data provided only relates to identified illicit transactions which the companies are able to identify, based on lists of known or suspected illicit addresses.”

For regulators and other governing entities, getting to the root of this issue and the discrepancies in reporting will be crucial to determining whether new laws to force crypto users out of anonymity should be required.

We examined the future of crypto regulations earlier this year, and several of our contributors noted that it is still unclear how things will play out. As this is still a hot-button issue, you can bet that there will be many discussions at Money20/20 on this topic.

Key Money20/20 Agenda Themes to Note

Aside from the trending topics you’re likely to encounter on the Money20/20 floor, there are several agenda themes, curated by the Money20/20 crew that will be permeating through the vast array of sessions.

Here’s a look at the four key focus areas and themes to note for this year’s event.

Vulnerability

At Money20/20 2022, “vulnerability” will be one of the four focus lenses from a content perspective, and according to US Content Director Zach Anderson Pettet, vulnerability is at the heart of innovation.

“It is only when we are open to new ideas and change that we can improve or re-create systems. It is also only when we are aware of our weaknesses that we can begin to solve problems. The world feels vulnerable right now, but every crisis presents opportunities for growth.”

Expect access to sessions targeting macro concepts like a pending recession, bear markets, and inflation. Speakers will also tackle trending topics like open and embedded finance, as well as safe data and cyber security.

Offense & Defense

The second content focus for Money20/20 2022 in Las Vegas is the concept of offense and defense. This event is the prime location to get strategic advice from hundreds of industry experts - whether your organization is looking for guidance on how to defend against fraud, or how to support others in the fight against financial crime, this is the place to take a stand.

Sessions at the Financial Crimes and Fraud summit will help you determine how to fight and when to defend yourself. On that note - don’t miss Unit21’s own Trisha Kothari alongside Crypto.com’s Chief Compliance Officer, Antonio Alvarez Lorenzo, and Intuit’s Head of BSA/AML, Rob DeCampos, for a panel called “Anti-Money Laundering: The Hidden Time Bombs.” More on that to come below.

Chain Reactions

The third area of focus is all about chain reactions. Sometimes, when one problem is solved, a slew of new challenges arise out of the ashes. Call it cause and effect or unknown unknowns - however you look at it, one thing always leads to another.

But that’s not to say that unintended consequences are all bad. New challenges often lead to new opportunities, which is why you can anticipate many conversations around evolutions in crypto, changing global rails, and network payments, you name it!

Experiences

The fourth and final key content lens for Money20/20 this year is “experiences.” As we enter a world where the horizons between digital and physical converge, you can expect to engage in discussions around Web3, the metaverse, NFTs, identity and privacy, and everything in between.

Best Activities and Experiences to Try

While you should definitely pack your event agenda with as many sessions as your brain can hold, there’s also room for a little fun.

Here’s a peek at some networking opportunities you should know about.

Happy Hour Event with Treasury Prime

Mix it up with the Treasury Prime team and fellow Fintech and banking leaders before the last day of the conference.

Network over complimentary drinks and bites and meet the Chief Payments Officer at Branch as well as best-selling author of “Anatomy of a Swipe,” Ahmed Siddiqui. Ahmed will be signing free copies of his book.

- When: October 25th - 5-7pm

- Where: Canaletto Restaurant Lounge located in St. Mark’s Square at The Venetian Hotel

All are welcome! RSVP here.

Networking and Parties:

Money20/20 will have a number of networking events and opportunities for attendees to check out. Here’s a basic rundown of the main parties and networking experiences to put on your event calendar:

- Sensations Party: Money20/20 will be hosting what they are referring to as a “mind bending multi-sensory party” in the Venetian Atrium. This celebration will include an evening of music, cocktails, and “sensory surprises.”

- House Party at OMNIA Las Vegas: This is the big party of the event, hosted at Caeser’s Palace Omnia club.

- Icon Concert: The closing party which includes a live performance from a musical artist at The Venetian. This concert is “a unique opportunity to experience a global iconic artist in the iconic Vegas setting of our Showtime Stage.”

Unit21 at Money20/20 Las Vegas

Now that you have a good idea of what to expect at the event, here’s what you can expect from Unit21. Save room in your event calendar for the following Unit21-specific activities.

Private Welcome Dinner

Join Unit21 and a collection of leading compliance professionals for an invite-only private dinner on Sunday, October 23rd.

Connect with other top professionals in risk and compliance in this intimate setting to:

- Celebrate your successes in stopping bad actors

- Discuss trends in the industry

- Be honest about the challenges you are trying to solve

- Enjoy drinks and a great meal!

Interested in receiving an invitation? Reach out to your rep for details!

[PANEL] Anti-Money Laundering: The Hidden Time Bombs

Session Details: Financial Crimes & Fraud Summit, Sunday Oct. 23th at 2:50pm - Delfino, Junior Ballroom, Level 4, The Venetian.

In 2020, $10.4 billion was paid in fines for money-laundering violations, but 90% of money laundering crimes went undetected. Current anti-money laundering systems are ticking time bombs but could AI and ML automation help stop the "boom?"

In this session, experts discuss the pros and cons of current AI and ML solutions that detect money laundering, the existing gaps, and effective AML processes.

This exciting panel will feature Crypto.com’s Chief Compliance Officer, Antonio Alvarez Lorenzo, Intuit’s Head of BSA/AML, Rob DeCampos, and Unit21’s very own CEO and Co-Founder, Trisha Kothari.

In the session, attendees will learn:

- How compliance is different for Fintechs and crypto companies versus traditional financial institutions

- How Fintechs and crypto companies should think about budgeting for compliance

- How to measure compliance team success and which KPIs should be tracked

- The top processes that Intuit and Crypto.com use to ensure they minimize fines

- How AI and automation are used for compliance operations

- The shortcomings of current AI and ML solutions for detecting money laundering and other financial crimes

- And whether or not risk and compliance can be fully automated in the future.

Hope to see you there!

The MoneyPot Podcast Booth: Embedded Finance: Is it Past Its Peak?

The MoneyPot offers listeners a dive deep into the ideas reshaping the future of money. Unit21’s Trisha Kothari will be recording an episode with Fintech Cafe’s Ambika Sharma and others on the topic of embedded finance, live at Money20/20 on Tuesday, Oct. 25th from 10:45am-11:30am on the topic of embedded finance.

In this unique experience, attendees can listen in via headphones and guests will be shown on the video screen. The MoneyPot podcast booth is across from the food court - you can’t miss it!

Meet the Unit21 Team at Booth

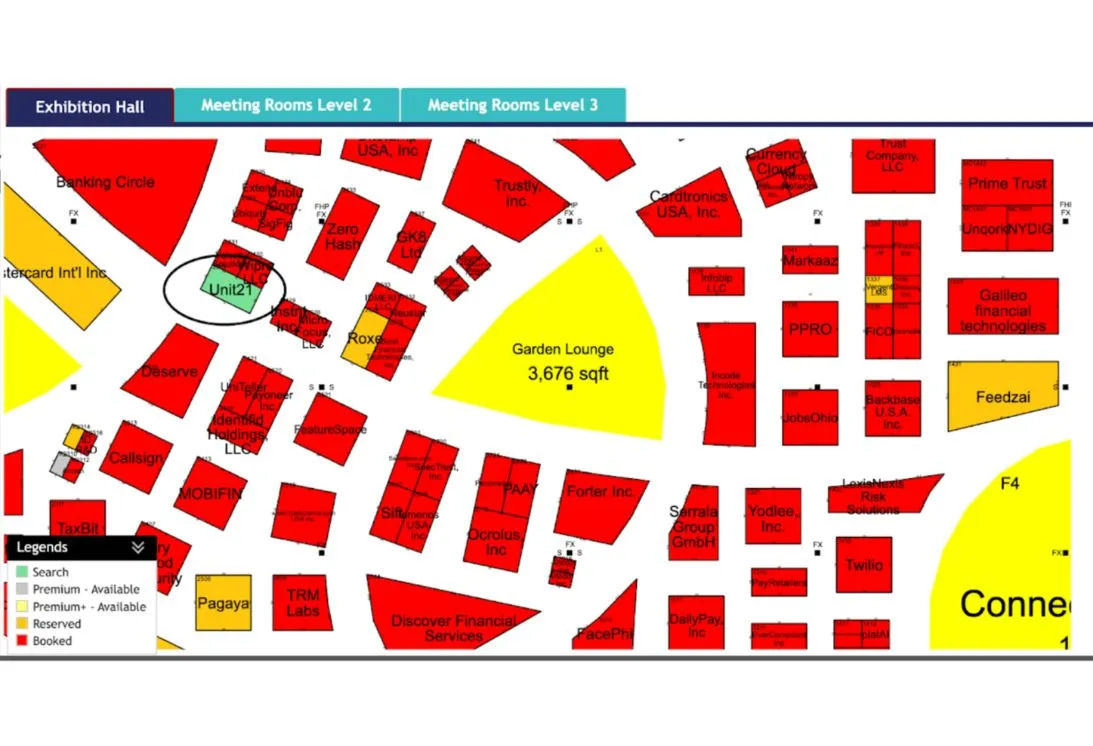

Looking for a break from all the chaos? Be sure to stop by booth #2329 (right across from the Banking Circle) to create a custom t-shirt! We’ll have a screen printing station offering unique AML and compliance-themed designs for you to choose from.

Interested in learning more about Unit21? Schedule an in-person demo and earn yourself a new Yeti mug as our gift to you.

Hope to see you there!

Money20/20 2022 USA: Concluding Thoughts

Money20/20 is undoubtedly the best place to get a pulse on the Fintech ecosystem, and this year’s event will be better than ever. We’re excited to join Fintech’s biggest conversation and can’t wait to see you there! Want to schedule a live meeting with someone from the Unit21 team? Click here to reserve a spot.

Subscribe to our Blog!

Please fill out the form below:

Learn more about Unit21

Unit21 is the leader in AI-powered fraud and AML, trusted by 200 customers across 90 countries, including Green Dot, Chime, and Sallie Mae. One unified platform brings detection, investigation, and decisioning together with intelligent automation, centralizing signals, eliminating busy work, and enabling faster responses to real risk.